Economic

Sri Lanka’s manufacturing and service sectors gain momentum

Sri Lanka’s manufacturing Sector marked an Increase in August 2018 compared to performance in the previous month, Central Bank sources said.

The expansion observed in manufacturing activities in August was mainly driven by expansion in production led by the increase in new orders, especially in manufacturing of textiles, wearing apparel, leather and other related products.

Further, employment also increased at a higher rate with the recruitment of employees especially for food and beverages sector led by the positive outlook for improving activities within this sector.

However, stock of purchases show some slowdown, especially in manufacturing of other non-metallic mineral products. Nevertheless, stock of purchases in the manufacturing of textiles, wearing apparel, leather and other related products increased.

However the Services sector continued to expand, albeit at a slower pace, in August 2018 supported by growth in New Businesses, Business Activity and Employment, Central Bank announced.

The growth in New Businesses was mainly observed in financial services and insurance sectors. Respondents cited establishment of digital banking units and improvements to service delivery channels as contributory factors to this growth.

Business Activity expanded mainly in accommodation food & beverage sector due to improvement in both local and foreign tourism.

Sri Lanka secures USD 1 billion loan from China

Sri Lanka's central bank on Friday announced it had secured a $1 billion Chinese loan as the island, a key link in Beijing's ambitious Belt and Road initiative, develops closer relations with Asia's largest economy.

Central bank Governor Indrajit Coomaraswamy said that first half of the loan will be released later this month and the balance will be received in October.

"During consultations (with the Chinese over the loan) it was clear that they see us as a key strategic partner as far as the (Belt and Road) initiative is concerned, given our location," Coomaraswamy told reporters in Colombo.

The eight-year loan by China Development Bank carries a 5.25 percent interest rate with a three year grace period.

Coomaraswamy said that the terms of Chinese loan were better than other international lenders and the country hopes to secure additional $200 to $250 million from China's domestic financial market by issuing "Panda bonds".

Last month, China vowed to keep providing financial help, including loans, to Sri Lanka despite warnings about the island nation's mounting debt.

Sri Lanka last year granted a 99-year lease on a strategic port to Beijing over its inability to repay Chinese loans for the $1.4 billion project.

The port in Colombo straddles the world's busiest east-west shipping route and also gives a strategic foothold to China in a region long dominated by India.

China had said its loan portfolio in Sri Lanka was $5.5 billion as of last month, just over a tenth of Colombo's total $51.82 billion external debt.

"China will continue to provide selfless support, including much-needed funds for the development of Sri Lanka," the Chinese embassy in Colombo said last month.

China's Belt and Road infrastructure project seeks to revive ancient trade routes through a massive rail and maritime network via $1 trillion in investments across Asia and Europe.

Sri Lanka & Oman Central Bank Chiefs' discuss ways of improving investment climate through banking channels

Dr. Indrajit Coomaraswami, Governor of the Central Bank of Sri Lanka (CBSL), and his accompanying delegation met with Tahir Salim Al Amri, Executive President of the Central Bank of Oman (CBO), at the CBO headquarters on Sunday.

The two sides reviewed the close bilateral relations between the two countries and also discussed ways to enhance further joint cooperation by increasing the frequency of knowledge sharing initiatives and exchange of expertise between the two countries.

The officials also discussed ways of improving investment climate through banking channels which are poised to contribute in increasing trade and investment flow, bringing significant benefits to both the countries.

During the meeting, CBSL officials provided a quick overview of Sri Lanka’s macroeconomic developments, its sovereign loan market, the banking sector and the prevalent favourable investment climate in the country.

The delegation which is on an official visit to Sultanate as part of a joint trade and cooperation exercise between the two friendly countries of Sri Lanka and Oman, will also meet CEOs of local banks in Oman.

Cabinet approval for Sri Lanka's National Export Strategy

A comprehensive and carefully structured five-year National Export Strategy (NES) aimed at increasing exports and generating enhanced revenue for Sri Lanka’s SMEs and exporters was approved by the Cabinet.

Sri Lanka’s economic growth, which is dependent on exports, requires continued structural changes aimed at greater diversification, innovation, productivity increases.

The National Export Strategy (NES) was developed by private and public stakeholders through extensive consultations which commenced from the First National Symposium held in April 2017 at Temple Trees, under the patronage of Prime Minister Ranil Wickremesinghe.

All export sectors including the mature sectors will benefit from the strengthening of trade support functions. These TSFs include National Quality Infrastructure, Innovation and R&D, Logistics and Trade Promotion. The NES for Sri Lanka was designed by the Ministry of Development Strategies and International Trade and the Sri Lanka Export Development Board (EDB) in consultation with private and public stakeholders.

Minister of Development Strategies and International Trade Malik Samarawickrama stated that the focus of the Government is to shift the economic growth model from one that was heavily dependent on debt fueled public infrastructure spending to growth driven by more public enterprises, exports and foreign direct investment.

Furthermore, the National Export Strategy will also complement other national initiatives such as the Enterprise Sri Lanka programme.

Port of Colombo ranks as world's leading container growth port

Sri Lanka's Port of Colombo was ranked the world's top port with the highest container growth in the first half of 2018, Sri Lanka's Ports and Shipping Ministry said in a statement on Sunday.

According to international rating agency Alphaliner, the Port of Colombo has recorded a 15.6-percent growth in container handling for the first half of this year, out of the top 30 global ports.

"It is a very significant achievement as it is the first time in history the Port of Colombo has reached the top of a global maritime ranking. With this growth, Port of Colombo has leaped ahead many other Asian ports," the statement said.

The Port of Colombo consists of the Jaya Container Terminal of the state-run Sri Lanka Ports Authority, South Asia Gateway Terminal of the John Keells Holdings and Colombo International Container Terminal of China's CM Ports.

Ports Minister Mahinda Samarasinghe said recently that the three terminals had inked a deal to jointly promote the port.

Under this deal, waiting time for all container vessels arriving at the Port of Colombo will be minimized by allowing vessels to be accommodated at the earliest available terminal.

Source: Xinhua

USD 9.5mn ADB grant to boost women entrepreneurs

Since the government has recognised that women led SMEs face significant difficulties in accessing finance, a grant of USD 12.5 million will be mobilized from the Asian Development Bank's (ADB) Women Entrepreneurs Finance Initiative (We – Fi), the Ministry of Finance said today.

Accordingly, a total of USD 12.5 million will be available where USD 9.5 million will be provided to women entrepreneurs on grant basis through participating financial institutions.

The balance amount of the grant will be used for technical assistance and administrative costs.

Additional incentives will also be provided for women who complete business skills training as well as for women entrepreneurs in Uva, Sabaragamuwa, Northern and Eastern provinces.

Dr. R H S Samarathunga, Secretary to the Ministry of Finance and Media and Sri Widowati, ADB's Country Director for Sri Lanka signed the grant agreement at the Ministry of Finance and Media on Friday (06).

Global factors behind rupee fall, no need for knee-jerk reaction: Arun Jaitley

NEW DELHI: Finance Minister Arun Jaitley on Wednesday attributed the fall in rupee to global factors and said there was no need for panic or knee-jerk reactions.

He further said the Reserve Bank is doing whatever is necessary to deal with the situation.

The rupee's unabated fall continued for the sixth straight session Wednesday as it hit yet another closing low of 71.75 against the US dollar, tumbling 17 paise.

The battered rupee has lost 165 paise in the last six trading sessions.

"If you look at the domestic economic situation and the global situation, there are virtually no domestic reasons which are attributable to this. The reasons are global.

"I don't think there is any need for the world's fastest growing economy to come out with panic and knee-jerk reactions," he said while replying to questions regarding the fall in rupee.

Jaitley further said the dollar has strengthened against almost every other currency and added that the rupee has consistently either strengthened or remained in a range.

"It has not weakened...the rupee is better-off," he said, adding that the rupee has strengthened against other currencies like the British Pound and the Euro.

The minister further said the government has consistently maintained 4 per cent inflation during the last four years.

Elaborating his point on global factors affecting the rupee, he said India is a net buyer of crude oil and spike in prices affects the country.

"That's an external factor. We are not in a trade war business but when countries neighbouring us devalue their currencies, that has a corresponding impact on us. Turkey had some impact on us," he said.

The minister further said eventually the inherent strength of the Indian economy has to play a very important role and expressed confidence that fluctuation in the currency market will come down.

"I am sure that the currency management in these areas are done by the Reserve Bank of India and they are certainly doing whatever is necessary for this purpose," he added.

Meanwhile, crude prices Wednesday extended their losses, sliding towards USD 77 a barrel.

Source: Economic Times

Sri Lanka tourist arrivals up by 19 percent in June 2018

Sri Lanka's tourist arrivals rose 19.0 percent in June this year compared to the same period last year, the data released by the Sri Lanka Tourism Development Authority (SLTDA) showed.

The month recorded 146,828 tourists arriving in the country compared to the 123,351 arrived in June 2017.

As at 30th June, 1,164,647 tourists had visited Sri Lanka for this year. It is a 15.3 percent growth over last year when 1,010,444 tourists had visited the country during the same period.

Over 2.1 million tourists arrived in Sri Lanka in 2017 contributing US$ 3.9 billion of earnings to the government revenues.

SL economy on track, higher growth can be achieved - ADB

Sri Lanka has the potential to go beyond an economic growth rate of 4 or 4.2 percent as its reform program is on track and the economy is supported by a strong private sector led growth, Asian Development Bank (ADB) Vice President Wencai Zhang told journalists during a media briefing on the Bank’s new long term corporate blueprint, ‘Strategy 2030’ for Asia and the Pacific region, in Colombo last week.

Zhang said four percent is still low. Sri Lanka has the potential. Notching four percent is not at all enough as the country could achieve a higher growth percentage due to many initiatives such as ‘Enterprise Sri Lanka’ launched by the government along with development moves to accelerate economic growth through an inclusive approach which will help trickle down the benefits of growth to all segments of society.

“However, Sri Lanka needs to look firmly at drivers of growth through private projects, investments and a vibrant export sector. Focusing on structural reforms and improving the ease of doing business from the current ranking will help the country to get to a better position in economic growth,” the ADB Vice President said. The Asian donor reaffirmed its strong commitment to support Sri Lanka’s continued development drive in keeping with its ‘Strategy 2030’ when its top officials met Prime Minister and other senior ministry officials in Colombo last week.

The bank expects to sign a total of US$ one billion in financing for nine projects in Sri Lanka this year and over the next three years ADB’s commitment will be $ three billion supporting development in areas such as ports, roads, secondary and higher education, electricity transmission and distribution, fisheries, irrigation, wastewater management, drinking water, sanitation and small and medium enterprises.

‘Strategy 2030’ which was approved by the ADB Board of Directors mid this year goes beyond ending poverty to promote prosperity, inclusiveness, resilience and sustainability in the Asia and the Pacific region.

“I am impressed by the vocational training education to youth in the country particularly in the South which I witnessed during my visit to the region during the week,’ Zhan said.

He also said he was pleased with training programs in the Uva and several other provinces.

However, the Bank’s delegation which was on a short visit to the country last week noted that prior to lending funds for new projects in Sri Lanka it evaluates the previous programs.

“ Sri Lanka honours its obligations for loans borrowed and overall the program implementation in Sri Lanka has been successful,” ADB Country Director Sri Widowati said.

When asked about the Bank’s role with the Chinese Belt and Road Initiative (BRI) Zhang said the Bank is always ready if need arises to support the BRI through co financing along with other multilateral and bilateral agencies.

Zhang said ADB will strengthen its country-focused approach to Sri Lanka, promote the use of innovative technologies, and deliver integrated interventions that combine expertise across a range of sectors and themes and through a mix of public and private sector operations.

According to the Bank Sri Lanka’s GDP (Gross Domestic Product) is expected to grow by 4.2 percent this year and 4.8 percent in 2019, inflation rate at 5.2 percent this year and 5 percent next year and per capita GDP to be at 3.2 percent in 2018 and 3.8 percent in 2019.

In its comparative economic forecast for Asia the Bank growth in India this year is expected to be at 7.3 percent, Bhutan at 7.1 percent, Bangladesh 7.0 percent, Maldives 6.7 percent, Pakistan 5.6 percent, Nepal 4.2 percent and Afghanistan 2.5 percent.

As at 31 July this year the Bank’s active project portfolio in Sri Lanka stands at 35 projects with a net loan amount of $3.9 billion.

During its stay the delegation visited ADB funded projects, including a Technical College in Mirijjawila, Southern Province, which offers vocational training courses in various skills including information communication technology, welding, carpentry, automobile mechanics, and landscaping.

Set up in 1966 the Bank comprises 67 members, 48 from the region. ADB’s operations last year totaled $32.2 billion, including $11.9 billion in co financing.

Source : Sunday Observer

Cabraal's growth scam; Treasury sets the record straight on Govt's outstanding debt

The General Treasury in a statement has responded to former Central Bank Governor Ajith Nivard Cabraal's recently published article under the heading, "The Government’s Growth Scam" by pointing out that the former Governor had tried to present a different and distorted viewpoint on the Central Government’s financial statement.

In this article, Mr. Cabraal claims that there is some discrepancy in published statistics on Gross Domestic Product (GDP) and Government’s Debt to GDP ratio. While leaving for the relevant institution to clarify on the matters relating to compilation of GDP statistics, the General Treasury would like to place the following on record on the outstanding Debt to GDP ratio of the Government.

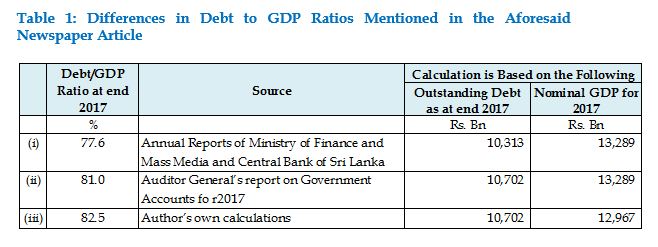

The writer in his article had mentioned three debt to GDP ratios to be applicable as at end of 2017, while arriving subjectively at his own GDP value as Rs 12,967 billion whereas the official figure is Rs 13,289 billion.

As per the decisions taken by the then Cabinet of Ministers during the period from 2010 to 2013, the loan obtained by certain State Own Enterprises (SoEs) were not included in the government’s Financial Statements. Accordingly, the previous government had transferred the loan balances of Hambantota Port Project, Mattala Airport, Ceylon Electricity Board and the Airport and Aviation Services Authority from the central government’s financial statement on the assumption that these debts could be repaid by the respective SoEs. It is pity that Mr Cabraal as the then Governor of the Central Bank who was privy to this decision is now trying to manipulate the debt to GDP ratio by citing the public policy of non-inclusion of debt, held by SoEs in the government’s balance sheet. This was a decision taken by the then government in which he was a prominent stakeholder in handling the government’s debt management.

The General Treasury has nothing to hide about the debt to GDP ratio or the highest debt liabilities to be meted out in 2018 and 2019. The government is on record to make the highest debt servicing of Rs 4.2 trillion in 2019 of which a substantial portion is to meet the maturity of loans obtained prior to 2015

Changing of GDP estimates by the author concerned based on his own assumptions, and then reporting a different Debt/GDP ratio is of no significance to the General Treasury. Because, the General Treasury relies on the independent GDP compiling authority, namely, Department of Census and Statistics, when it comes to computing ratios of government statistics vis-a-vis GDP. Hence, the so called Debt/GDP ratio of 82.5 percent as reported in the newspaper article is a hypothetical figure for which the General Treasury would not need to comment on.

However, the General Treasury would like to explain the difference between officially published government debt of Rs. 10,313 bn at end 2017 and Auditor General’s calculations of Rs. 10,702 bn, which led to the increase of Debt/GDP ratio from 77.6 percent to 81.0 percent as at end 2017. It is important to note at the outset that such difference is entirely due to classification differences of certain debt obligations as reported in Government’s accounts and Auditor General’s report. Such classification differences are explained below.

A majority of such classification difference is due to the transfer of debt liability relating to eight loan agreements from the Central Government to the respective State-Owned-Enterprises (SOEs) by Cabinet decisions taken during 2010 and 2013. According to Auditor General’s report on Government Accounts for 2017, “The debt balance of Rs.330,221 million remained as at 31 December 2017 relating to 08 loan agreements entered into by the Government under the contractual agreements had not been included in these financial statement.

The remaining difference between officially published outstanding debt balance of Rs. 10,313 bn and Auditor General’s calculations of Rs. 10,702 bn as at end 2017 is mainly due to exclusion of Treasury bonds issued to two State-Owned-Enterprises, namely, Ceylon Petroleum Corporation (CPC) and Sri Lankan Airlines for settling dues. As reported in the Annual Report of Central Bank of Sri Lanka for 2017 (Statistical Appendix, Table 118), the outstanding debt balance of Rs. 10,313 bn excludes treasury bonds issued to CPC in January 2012 to settle dues; and to Sri Lankan Airlines in March 2013 for capitalization purposes, which in total amounts to an outstanding balance of Rs. 69.8 bn as at end 2017. Any remaining marginal difference if exists, can be attributable to the net credit to government from banking sector operations.

Thus, the classification differences in government debt statistics as highlighted date back to debt management measures implemented during 2010 through 2013. This has caused confusion among the general public, hence, corrective measures would be taken in due course. Nonetheless, any attempt to discredit the official statistics on government debt at present deems to call into question the debt management measures taken then, while serving no any other purpose in the interest of the economy.

Current government is determined to consolidate the outstanding government debt over the medium-term supported by a credible fiscal consolidation framework. The envisaged path for primary surplus and current account surplus in fiscal operations would ensure a steady fall in Debt/GDP ratio in the coming years. Having recognized the Government’s fiscal consolidation plan, the international organizations such as International Monetary Fund (IMF) and World Bank project a lower Debt/GDP ratio for Sri Lanka over the medium-term. For instance, IMF Staff Report on Sri Lanka published in June 2018 projects Sri Lanka’s Debt/GDP ratio at 66.7 percent by 2023 (Source:https://www.imf.org/en/Publications/CR/Issues/2018/06/19/Sri-Lanka-2018-Article-IV-Consultation-and-the-Fourth-Review-Under-the-Extended-Arrangement-45997). Such projections would necessarily inform the international rating agencies in their review of Sri Lanka’s debt sustainability and overall economic stability over the medium-term.

Indian Rupee weakens further against US dollar

The Indian rupee along with emerging Asian currencies weakened against the US dollar on Friday as prospects for a quick resolution of the US-China trade war faded after two days of talks ended with little progress.

So far this year, the rupee has weakened 8.9%, while foreign investors have sold $493.40 million and $5.57 billion in equity and debt markets, respectively. Photo: Reuters

Traders are waiting for a speech by Federal Reserve Chairman Jerome Powell later in the day. At 9.10am, the rupee was trading at 70.23 a dollar, down 0.15%, from its Thursday’s close of 70.11. The home currency opened at 70.20 a dollar and touched a low of 70.23.

Asian currencies were trading weaker as the South Korean Won was down 0.2%, China Renminbi 0.16%, Indonesian Rupiah 0.16%, Japanese Yen 0.12%, Malaysian Ringgit 0.11%, Taiwan Dollar 0.11% and Philippines Peso 0.08%. However, China Offshore was up 0.17%.

Ten Young Entrepreneurs Receives Boc “Thurunu Diriya” Loans

“Thurunu diriya” a special loan scheme has been launched by the Bank of Ceylon (BOC) as a result of discussions held by the Policy Development Office (PDO) of the Prime Minister’s Office, Small Enterprises Development Division (SEDD) and the Central Programme Management Unit (CPMU) of the Ministry of National Policies & Economic Affairs with BOC.

E.D.A.T. Gunadasa of Ankumbura BOC branch became the first entrepreneur ever to receive the “Thurunu diriya” loan and 9 other young entrepreneurs have already received this loan scheme followed by him. Granting of the rest of the loans for the selected beneficiaries are now in process.

The scheme aims at providing special loan scheme for professionally qualified young entrepreneurs under the age of 35 years who already have businesses. This will assist them to expand and stabilize their businesses, which will contribute to the economic development of the country.

Awareness programmes have been conducted by the Small-Scale Development Divisions which are under the District Secretariats to identify the potential young entrepreneurs. 904 beneficiaries who are eligible for the above loan scheme have already been selected from the large number of loan applications received by the BOC.

During the loan application period, these beneficiaries can seek assistance from field officers who are attached to the Divisional secretariats to prepare business plans and other required documentation. 366 business plans have already been handed over to the Divisional secretariats while 102 out of them have been handed over to the BOC.

Further details of this loan scheme can be obtained from the nearest Bank of Ceylon branch or the Divisional secretariat office.

Page 14 of 20