Economic

2018 coup and Easter attacks significantly impact fiscal performance: IMF

The protracted impact of the 2018 political crisis and the Easter attacks are significantly impacting fiscal performance, the IMF claimed.

The end-June fiscal target was missed by a large margin, due to frontloading of spending from the clearing of arrears and externally-financed capital projects carried over from 2018 as well as a sharp fall in indirect revenues following the terrorist attacks.

The team reached understandings at the staff level with the Sri Lankan authorities on the sixth review of the EFF-supported program.

The team praised the authorities’ efforts to normalize the security situation in the country after the tragic terrorist attacks in April and mitigate the impact of the shock on the economy.

The new Central Bank Act will be a landmark reform in the roadmap towards flexible inflation targeting by strengthening the CBSL’s mandate, governance, accountability, and transparency, in line with international best practice, the IMF said.

The mission welcomed the authorities’ commitment to advance revenue-based fiscal consolidation in 2020 and over the medium term to preserve the gains achieved under the program.

It has put the high public debt on a downward path, and provide space for better-targeted social and capital spending.

CBSL to crack down on errant money changers

Sri Lanka’s authorised money changers numbering around 65 in Colombo and suburbs have come under Central Bank scrutiny following allegations that they are siphoning off vast amounts of foreign currency.

Authorised dealers are required to hand over the foreign currency they buy to the Central Bank and obtain proceeds in Sri Lankan Rupees.

As part of the investigations, Central Bank officials in disguise are visiting authorised money changers to check whether they are involved in illegal transactions.

These investigations followed complaints that authorised money changers who were only allowed to buy foreign currency and deposit it with the Central Bank were involved in major rackets and financial misappropriations.

Under existing laws authorised money changers should deposit a minimum of US dollars 1.5 million a year with the Central Bank.

A senior treasury official said it had been revealed that the foreign exchange brought into the country was not being fully contributed to the national reserve as part of the money was smuggled out of the country.

Therefore, the Central Bank will take stern action against unauthorised money changers and errant foreign exchange dealers.

However, Authorised Money Changers Association claimed that they were finding it difficult to continue with the business as there were several unauthorised money changers and no action was being taken against them.

He said there were only 65 authorised money changers, but there were a large number who were operating without a licence.

He denied allegations that the authorised money changers were involved in large scale foreign currency rackets.

The Central Bank annually receives more than Rs. 7 billion from money changers.

Central Bank Governor extols the new Monetary Law Act

The Governor of the Central Bank Dr. Indrajit Coomaraswamy says that the proposed Monetary Law Act, will strengthen stability in monetary policy.

Sri Lanka is in the process of introducing a new law governing central banking in the country in place of the current Monetary Law Act.

Amending this 70-year old law is a long-felt need, in order to update its provisions with regard to monetary policy formulation in line with international best practices, and also to introduce a strong macro-prudential policy framework aimed at preserving the stability of the financial system

Dr. Coomaraswamy stated that whenever the Government had fiscal indiscipline and was short of money, it forces the Central Bank to print money noting that effectively printing causes inflation.

He was of the view that the Central Bank should not be involved in print money and buy treasury bills from the government in the primary auction.

He disclosed that the aim of the proposed new monetary law act to provide provisions that the Central Bank by law should be prevented from participating in the primary auction for treasury bills.

“The Central Bank should not print money. It should be prevented from printing money, and this would be a significant improvement in our monetary policy formulation," he emphasized.

Japan reaffirms commitment to develop East Container Terminal

Dr. Hiroto Izumi, the Japanese Prime Minister’s Special Advisor, reaffirmed his Government’s commitment to develop the East Container Terminal of the Colombo South Harbour as a joint venture partnership of Sri Lanka and India, at a meeting he had with Prime Minister Ranil Wickremesinghe recently.

Prime Minister Wickremesinghe met Dr. Hiroto Izumi, the Japanese Prime Minister’s Special Advisor, Akira Sugiyama, Ambassador of Japan and his team at Temple Trees.

“We made great progress on Japan- Sri Lanka economic cooperation,” the Prime Minister said.

“The East Container Terminal of the Colombo South Harbour will remain under the ownership of Sri Lanka, while there will be a joint venture with the partnership of Sri Lanka, India and Japan to manage the terminal. The Bandaranaike International Airport expansion project will also receive Japanese assistance. The light Railway Transit (LRT) project is now underway,” Prime Minister Wickremesinghe said.

“A LNG terminal will be built in Sri Lanka with Japanese assistance. Under the Greater Kandy Urban Development Plan, the City of Kandy will be developed with an aim to preserve the landscape and attract tourists, in line of the master plan developed for the City of Kyoto, Japan,” the Prime Minister Wickremesinghe further added.

During the meeting, the two sides also discussed the freedom of navigation in the Indian Ocean.

Finance Minister Mangala Samaraweera, Kabir Hashim, Malik Samarawickrema, Sagala Ratnayaka and Prime Minister’s Secretary Saman Ekanayake and Treasury Secretary Dr. R. H. S. Samarathunga were also present at the meeting.

Economists advocate upcoming government to shift fiscal policy

Several leading economists expressed their dismay on the statement made by a high ranking official of the Central Bank who stressed on the need to maintain the present fiscal policy by the new government which will come in to power next year.

In an interview with Reuters news agency, the Central Bank’s senior deputy Governor, Nandalal Weerasinghe warned that Sri Lanka could lose access to global debt markets if a new government shifts away from the country's current fiscal policy.

"How can Nandalal make such a prediction without knowing the global debt market behavior in 2020 and beyond?," an eminent economist who wished to remain anonymous asked adding that in an ever changing world the upcoming government would be able to change fiscal policies accordingly.

Policymakers should start paying more attention to what’s called structural fiscal policies, that is, changes in both public spending and tax collection to aid the expansion of the productive potential of economies, he said.

“First, cyclical weaknesses should have to be overcome. High government debt and limited fiscal space also call for a change of strategy," he said.

The fiscal efforts over the last decade have done little to address the structural impediments to growth and there has been a slowdown in productivity growth since 2015 under the present regime. he added.

The Central Bank's conduct of monetary policy was questionable during the last couple of decades, especially during the previous Rajapaksa regime under a set of senior officials like Ajith Cabraal, P Samarasiri, Dr. Nandalal Weerasinghe and Ananda Silva whose names were mentioned in the Presidential Commission which had examined the bond issue, another well respected economist said.

Third, inequality has been trending up in many countries, despite much progress in raising living standards across the developing world in the last few decades.

Given this background, one cannot help but wonder whether the statement of Dr. Nandalal Werasinghe is anything more than his arrogant behavior along with an attempt to boost his own image which is already tarnished after the bond scam.

His credibility had been challenged in a motion submitted to the Colombo Magistrate's Court several months ago which named the Senior Deputy Governor of the Central Bank, Dr. Nandalal Weerasinghe and the retired Deputy Governor Ananda Silva as suspects in the Central Bank bond scam.

Sri Lanka in talks for $1 billion loan from Chinese lender to develop highways and energy sectors

Sri Lanka is in talks with the Beijing-backed Asian Infrastructure Investment Bank for a $1 billion dollar loan, the finance ministry said, to help an economy that has been badly hit by a deadly terrorist attack and political turmoil.

“We have been discussing with the Asian Infrastructure Investment Bank to obtain nearly an additional $1 billion for further development of the Power and Highway sectors,” the ministry said in a statement late on Thursday.

The ministry said that the bank also approved $280 million for a renovations in the capital Colombo.

The ministry said that there are projects worth around $271 million being carried out across the country to boost growth.

Sri Lanka has been beset by political infighting since President Maithripala Sirisena sacked Prime Minister Ranil Wickremesinghe in October last year, before reinstating him weeks later after a constitutional crisis that hit the economy.

More recently, the lucrative tourism industry was badly hit after the Easter Sunday bomb attacks by Islamic militants that killed 250 people.

Sri Lanka’s economy grew at 3.7 per cent, its fastest pace in nearly a year from January to March, accelerating from a growth rate of 1.8 per cent the previous quarter – its slowest pace since early 2014, due to the political crisis.

But despite the recovery at the start of the year, growth will likely slump to a nearly two-decade low in 2019, a Reuters poll showed, as tourism, foreign investment and business activity eased sharply in the wake of the bombings.

Last month, central bank Governor Indrajit Coomaraswamy said he expected the economy to grow by 3 per cent or less this year, due to the impact of the bombings.

The bank had earlier projected 4 per cent growth.

Foreign investment outflow retards even amidst current volatility

On a cumulative basis, net outflows in the government securities market amounted to US$ 96 million during the first half of the year.

Foreign investments in the CSE, including primary and secondary market transactions, recorded a net inflow of US dollars 10 million during the month of June 2019.

On a cumulative basis, the CSE recorded a net outflow of US$ 10 million in the first half of 2019, including primary and secondary market transactions.

Further, long term loans to the government recorded a net outflow of US$ 99 million during June 2019

Along with the proceeds of the International Sovereign Bond (ISB) of US$ 2 billion, issued in June 2019, the level of gross official reserves of the country increased to US$ 8.9 billion by end June 2019 (equivalent to 5.2 months of imports) from US$ 6.7 billion recorded at end May 2019.

Meanwhile, total foreign assets which consist of gross official reserves and foreign assets of the banking sector, were recorded at US$ 11.5 billion as at end June 2019, which was equivalent to 6.8 months of imports.

Sri Lanka stocks hover near 6-week high as trade turnover zooms

Sri Lankan shares ended marginally higher on Monday, hovering near a six-week high hit last week, as trade turnover touched a more than four-month high amid continued foreign fund outflows, while the rupee ended weaker on dollar demand from importers.

The benchmark stock index ended 0.02% firmer at 5,384.93, steadying near its highest close since May 3 hit on Thursday. The bourse rose 1.61% last week but it has fallen 11.03% this year so far.

The Central Bank cut its key interest rates on May 31 to support a faltering economy as overall business and consumer confidence slumped following deadly bomb attacks in April.

(Reuters)

Sri Lanka's Market: An Investment Gem Hidden In Too Much Pessimism

Legendary billionaire investor George Soros famously observed that “the most money is made when things go from terribly awful to just awful.” Coincidentally, this is also the time when hardly anyone wants to invest.

Few markets in the region probably embody that adage more than Sri Lanka. Currently classified as an Asian frontier market in the same company as Vietnam, Pakistan, Bangladesh and Kazakhstan among others, the country's political instability grabbed the world's attention on Easter Sunday when suicide bombers attacked three churches and three tourist hotels. While media focus was and still is pessimistic, Sri Lanka is recovering and rebuilding. A great deal of hope is riding on the December 2019 elections and this could indeed be a turning point for the nation.

For investors, Sri Lanka offers a strong diversification benefit in the event that global market volatility increases. The correlation between U.S. equities and India indicate a strong positive correlation based on last five years of market data. Sri Lanka, on the other hand, has a negative correlation with both markets. The correlation between Sri Lanka stocks and India's Nifty 50 and the S&P 500 in the U.S. is negative 0.442 and negative 0.556, respectively, according to Bloomberg data.

Mark Mobius, the veteran investor who earned the moniker as the "father of emerging markets," believes the outlook for both Sri Lanka's bonds and equities, which currently have valuations at 10-year lows, will rise as the political situation improves.

The CSE (Colombo Stock Exchange) is currently trading at 8.3 times earnings and the Sri Lanka Investable Universe of 305 stocks BF (blended forward) is 7.3 times earnings. By comparison, India's stock market is at 27.9 times earnings.

Against this backdrop, there are opportunities for value investing. Colombo's ASPI (All Share Price Index) is trading at 8.3 times current year earnings, a 10% discount to the last 3-year average, and at a 32% discount to the MSCI Frontier Markets Index.

The Central Bank of Sri Lanka on May 31 cut its benchmark interest rate for the first time in more than a year to support the flagging economy, which grew at 3.2% in 2018 amid a protracted political leadership crisis. Then came the terrorist attacks, which killed more than 250 people. As a direct impact of the Easter Sunday tragedy earnings from tourism in May have plunged by –70.8% to $71 million from $243 million a year earlier, according to the Sri Lanka Tourism Office. The tourism industry accounts for 5% of Sri Lanka’s $87 billion economy.

Sri Lanka has been struggling to revive economic growth following a three-decade long civil conflict that ended in 2009 and ongoing political turmoil. Tourism arrivals have increased more than fivefold since the war ended and revenue from the industry is near a record. In order to promote tourism, Sri Lanka will soon offer free visa travel to Indian passport holders beginning August 1. Indians are the largest group of travelers to the country, followed by China, which also included in the visa free policy.

While India's finance minister has ruled out reconsidering a plan to issue foreign currency overseas sovereign bonds, Sri Lanka is marketing dollar-denominated bonds in overseas markets for the second time since March. The country's 7.55% coupon sovereign issue of $1.5 billion was 4 times oversubscribed as the search for yield pushed investors out further out on the risk curve. Dulindra Fernando, the manager of the Ceylon Dollar Bond Fund stated that U.S. dollar returns on Sri Lanka's sovereign debt fund had reached 8.56% during the first six months of this year alone.

The country's borrowers are finding a window for issuance after the Federal Reserve cut interest rates, and the European Central Bank has said that extra monetary stimulus might be needed. And that's because bonds that trade with negative yields have reached $14 trillion, which is equivalent to 25% of the global bond market, according to Deutsche Bank research.

Sri Lanka with its country rating of B has been deemed "speculative" by the rating agencies. Historically, Sri Lanka has traded above both Pakistan and Mongolia in sovereign credit spreads, but this year due to excessive pessimism Sri Lanka is now below both nations in credit quality. As Sri Lank's political stability improves with the new election, we should expect to see its credit spreads narrow.

Since 2014, South Asia has been the fastest growing subregion in the world, with its eight economies collectively boasting average annual growth of 7%. This is even higher than East Asia's 6.2%. But Sri Lanka is still overlooked and under-researched by global investors, which means it might be an attractive opportunity for a limited time.

Rainer Michael Preiss is a portfolio strategist based in Singapore, covering global macro, geopolitics, frontier and emerging markets as well as Blockchain and emerging Tech.

ADB enhances access to credit for Micro and Small Rural Entrepreneurs

The Asian Development Bank (ADB), the Government of Sri Lanka, and the Regional Development Bank (RDB) on Friday signed loan and guarantee agreements to further assist Sri Lanka to provide affordable and accessible credit to rural micro, small, and medium-sized enterprises (MSMEs) in the country. Under the financial agreements, ADB will provide a $50 million loan with sovereign guarantee from the Government of Sri Lanka.

“MSMEs have high growth potential, create more jobs, and over time, potentially increase the tax base at a quicker pace than larger enterprises,” said ADB Country Director for Sri Lanka Ms. Sri Widowati. “Because of their distribution over the whole country, they also help reduce regional inequalities”.

Ms. Widowati signed the guarantee agreement on behalf of ADB while Dr. R.H.S. Samaratunga, Secretary to the Treasury, Ministry of Finance, signed for the Government of Sri Lanka. In addition, a loan agreement was signed between ADB and RDB.

With only about 30% of Sri Lankan firms having sufficient access to bank loans and other capital, limited access to finance is a key barrier facing entrepreneurs in Sri Lanka. These constraints are even greater for micro and small enterprises led by women or located in rural areas.

The project will not only directly fund $50 million of long-term financing through RDB to micro and small enterprises outside of Colombo, including women-led businesses, but will also be structured to provide RDB the additional regulatory capital that would leverage up to an additional $533 million of lending to MSMEs.

Implemented through the RDB, a state-owned bank whose mission is to strengthen the living standards of the rural population by providing affordable and accessible credit facilities; the bank’s unique business model and wider branch network across rural areas can effectively cater to rural small and micro enterprises that are mostly missed out by the private sector commercial banks.

Integral to the project is a technical assistance (TA) grant of $1 million from the Japan Fund for Poverty Reduction, financed by the Government of Japan, to support RDB’s sustainable long-term growth. The TA will upgrade RDB’s business model and directly promote gender mainstreaming through trainings to about 500 women entrepreneurs.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. In 2018, it made commitments of new loans and grants amounting to $21.6 billion. Established in 1966, it is owned by 68 members—49 from the region.

CSE records a new high in July despite terror attacks

Sri Lankan shares are set to open up next week afresh after ending a record-breaking month of July, stock market analysts said. The improvement of the external sector performance, local exports, lower interest rates and decrease of imports created some positive investment sentiment, they pointed out.

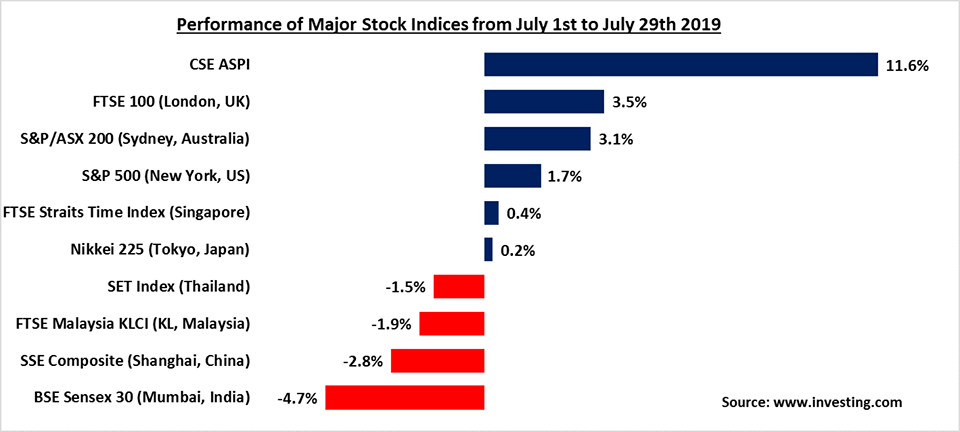

The retail market participation in stock trading has been improved significantly during the month of July, analysts said. Sri Lanka’s All Share Price Index (ASPI) has increased by 620 points for the month of July 2019 taking the ASPI from 5372.28 points to just under 6,000 points, closing on a 6 month high.

Finance Minister Mangala Samaraweera said that growth during this period amounted to 11.6% outperforming all major global stock indices.

Sri Lanka’s S&P20 Index has performed particularly well during this period growing 22% in the month, taking the index from 2,450 points to 3,051 points.

The market has responded to the improvement in macroeconomic stability as inflation declined to 2.1% in June, interest rates (1 year TB) declined by over 250 basis points this year.

Tourism and consumption is recovering quickly after Easter Sunday attacks, and the Rupee has appreciated 3.7% this year as the trade deficit has declined rapidly. The return of the EPF to the equity market, under prudent governance structures, is another boost to the equity market, stock market analysts said.

CBSL extends ban on Pan Asia Bank's primary dealership

The Monetary Board of the Central Bank of Sri Lanka (CBSL), acting in terms of the regulations made under the Registered Stock and Securities Ordinance and the Local Treasury Bills Ordinance, announced that they have decided to extend the suspension of business and activities of the Primary Dealer Unit of Pan Asia Banking Corporation PLC (PABC) for a period of six months with effect from 10.00 a.m. on 15th February 2019, in order to continue the investigations being conducted by the Central Bank.

CBSL emphasised that this regulatory action suspends PABC’s access to the primary auctions for government securities. Furthermore, it does not affect any of the other activities/services of PABC.

Page 9 of 20