Economic

CBSL conducts technical session on 'forging ahead with resilience' for bank directors

The Central Bank of Sri Lanka with a view to ensuring a stronger and dynamic banking sector which is capable of proactively facing challenges in digital era, hosted a Technical Session to further enhance and update the knowledge of Boards of Directors, Chief Executive Officers and other Key Management Personnel of all licensed banks operating in Sri Lanka, under the theme “Forging Ahead with Resilience”, on 14 November 2018 at the Centre for Banking Studies, Rajagiriya.

The Governor of the Central Bank of Sri Lanka delivered the opening remarks, giving an overview on the state of the economy and the rationale for the recent monetary policy stance of the Central Bank of Sri Lanka. The Governor highlighted the measures taken to strengthen the regulatory framework for banks in terms of capital requirements, technology risk management and governance. The Governor further indicated that with the emergence of fintech and advanced technologies like blockchain, the business models of banks may change significantly over time while opening up new business opportunities.

However, adoption of these new technologies need to be encouraged while ensuring the safety and soundness of the banking system. The Director of Bank Supervision presented the banking sector performance and the regulatory developments, highlighting the proposed measures to strengthen the enforcement powers, enhanced capital requirements for banks, implementation of the Basel III framework and prudent adoption of SLFRS 9.

The Technical session was enriched with insightful experiences of the three eminent resource persons on timely topics such as the culture and conduct of future Boards, technology risk resilience of banks and anti-money laundering compliance challenges in the digital era. Mr. Carl Hollingsworth, Regional Head, Subsidiary Governance, ASEAN & South Asia, Greater China and North Asia, Standard Chartered Bank, elaborated on the culture and embedding conduct of boards and new skill requirements for the future board of directors. Mr. Bryan MacKinnon, Asia Pacific Regional Head for Business Continuity Management and Technology Risk Management, Citibank, N. A. enhanced the knowledge of the bank directors on technology risk management and cyber security measures that need to be put in place to ensure technology risk resilience. Mr. Kevin Whelan, Resident Adviser, U.S. Department of the Treasury Office of Technical Assistance, highlighted the challenges/opportunities for regulators and banks with the development of FinTech and the anti-money laundering challenges faced by banks in the digital banking landscape.

The Technical Session was attended by over 200 participants including Chairpersons and Directors of locally incorporated banks, regional representatives overseeing the foreign banks operating in Sri Lanka, Chief Executive Officers, Chief Operating Officers, Chief Risk Officers and Compliance Officers of all licensed banks and senior officials of the Central Bank of Sri Lanka.

The Central Bank of Sri Lanka considers it imperative to ensure that the Directors and the Key Management Personnel of licensed banks keep abreast of the developments in financial technology, new risks emerging from such technologies and regulatory developments relating to the financial sector. Accordingly, the Central Bank conducted this technical session to enhance the knowledge of bank Directors and to further strengthen the interaction with the Boards of Directors and the Key Management Personnel of licensed banks. This session was conducted by the Central Bank in addition to its periodic meetings with Chairpersons and Chief Executive Officers of licensed banks and envisages to continue such dialogues in the interest of the stability of the banking sector.

Sri Lanka’s import cost outweighs export earnings

Sri Lanka’s export earnings grew by 5.8 per cent (year-on-year) to USD 7,842 million during the first eight months this year while imports increased by 10.9 percent, Central Bank’s weekly economic review revealed.

This was a result of higher earnings from exports of textiles and garments, petroleum and rubber products, machinery and mechanical appliances food, beverages and tobacco and base metals.

Import expenditure stood at USD 15,083 million during the first eight months of 2018 increased by 10.9 per cent (year-on-year).

Imports of fuel ,personal vehicles and textiles have contributed to higher export expenditure.

As a result, the deficit in the trade account expanded to USD 7,240 million during the first eight months this year from USD 6,184 million in the corresponding period of 2017.

The export unit value index increased by 0.4 per cent (year-on-year) in August 2018 mainly due to high prices registered in industrial exports.

The import unit value index in August 2018 increased by 2.0 per cent (year-on-year) due to high prices recorded in intermediate goods and consumer goods imports.

Accordingly, the terms of trade deteriorated by 1.5 per cent (year-on-year) to 102.7 index points in August 2018.

Sri Lanka's service sector records a higher growth: CBSL

Despite the prevailing political uncertainty, Sri Lanka's service sector grew at a higher pace in October, underpinned by a strong upturn in business activities and new businesses, the Central Bank announced.

The expansion in business activities was seen mainly across financial services, transportation and warehousing sub sectors. However, respondents of the Central Bank survey cited that the depreciation of the local currency had an adverse impact on import volumes and thereby on their activity growth.

New businesses also expanded across financial services and professional services sub sectors. Employment levels grew at a higher rate in October owing to the expansion in business activities.

Service providers have expressed optimism on the three months business outlook strengthened in October 2018 due to upcoming festive season and the peak season for tourism.

However, respondents raised concerns over the current political situation and the weakening of the domestic currency which could moderate the realisation of expectations.

Prices charged by the service sector increased at a higher rate while the expected labour cost in the service sector also increased during October due to bonus payments

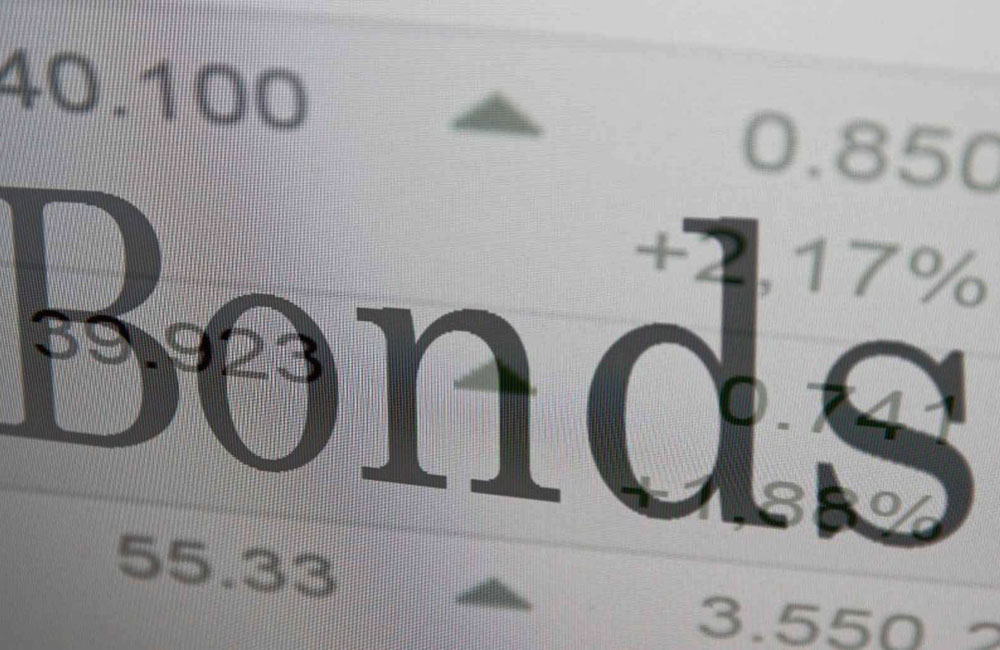

Bond Buyers Scorched as Sri Lanka's Promise Turns to Crisis

When Sri Lanka offered 10-year bonds at a juicy yield of 6.75 percent earlier this year, investors lapped them up. Lured by expectations for an economic recovery, asset managers put in orders for nearly three times the $1.25 billion sold.

Six months later, the bonds have slumped to less than 87 cents on the dollar, as a leadership struggle plunged Sri Lanka into a constitutional crisis. The capital Colombo has been gripped by political intrigue since President Maithripala Sirisena suspended parliament and said he had to fire Prime Minister Ranil Wickremesinghe because of an assassination plot.

While Sri Lanka had been winning back investors following the end of a brutal 26-year civil war in 2009, new challenges had emerged even before the crisis, with economic growth falling to the least since 2001 last year. The sell-off is also fueling concerns over Sri Lanka’s upcoming debt maturities, including $1 billion of dollar bonds due January and another $500 million in April.

“The timing of this political crisis is very poor” said Arthur Lau, head of Asia ex-Japan fixed income at PineBridge Investments, which is “underweight” on the nation’s debt. “Sri Lanka clearly needs some external financing.”

There is a “significant risk” as one administration transitions to another and investors will demand a risk premium, especially if the rhetoric is not market-friendly, Lau said.

The Sri Lankan rupee fell further on Tuesday to a record low of 174.45 against the dollar, following a warning the country could descend into political violence if the legislature remains suspended.

Wider SpreadsHowever, Aberdeen Standard Investments said the declines in the Sri Lankan bonds meant they were arguably no longer expensive as spreads had moved wider than Pakistan, Mongolia and almost all of sub-Saharan Africa.

“We are having an active debate on whether it’s worth covering at least some of our long-standing underweight of the credit,” said Edwin Gutierrez, the London-based head of emerging-market sovereign debt at Aberdeen Standard.

Others flagged concerns in the wake of the political crisis. It calls into question whether the International Monetary Fund will grant Sri Lanka an extension of its current assistance program, said Karan Talwar, an investment specialist for emerging-market debt at BNP Paribas Asset Management in Hong Kong.

“We have been generally cautious on Sri Lanka” due to its high levels of dollar debt, current-account deficit and depreciating currency, he said.

Almost half of the country’s public debt is in foreign currencies, according to Fitch Ratings.

(Bloomberg)

Sri Lanka raises key interest rate to stave off inflation

With the aim of stabilizing Sri Lanka’s inflation at mid single digit level, the Central Bank has raised its policy rate on Wednesday (14), after one and half years.

In order to neutralise the impact of this reduction and maintain its neutral monetary policy stance, the Monetary Board of the Central Bank has decided to increase the Standing Deposit Facility Rate (SDFR) of the Central Bank by 75 basis points to 8.00 per cent and the Standing Lending Facility Rate (SLFR) of the Central Bank by 50 basis points to 9.00 per cent, Central Bank announced.

The Monetary Board, at its meeting held today, decided to reduce the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of commercial banks by 1.50 percentage points to 6.00 per cent.The Board arrived at this decision following a careful analysis of current and expected developments in the domestic and global economy and the domestic financial market, with the broad aim of stabilising inflation at mid single digit levels in the medium term to enable the economy to reach its potential.

Tight monetary conditions persisted in the domestic market and the large and persistent shortage in rupee liquidity required the Central Bank to conduct open market operations (OMOs) on a short- and long-term basis in addition to overnight operations.The significant growth in imports as well as recent capital outflows amidst the broad based strengthening of the US dollar exerted pressure on the exchange rate.

Although the pace of depreciation has moderated recently, the Sri Lankan rupee has depreciated by 12.9 per cent against the US dollar during 2018 up to 13 November.Meanwhile, supported by the receipt of the foreign currency term financing facility of US dollars 1 billion by the government, gross official reserves amounted to US dollars 7.9 billion as at end October 2018, providing an import cover of 4.2 months

Sri Lanka’s IMF programme restrains populist measures with an election in sight

Sri Lanka will be tightening policy spaces in the monetary, fiscal and external fronts amidst subdued economic performance under the present economic and political situation in the country, Central Bank sources said.

Private sector led growth is to be facilitated with prudent, consistent and far reaching reforms that support increased productivity in the economy, officials said.

However, a push to adopt more populist measures with an election in sight will be restrained by Sri Lanka’s programme with the IMF till mid-2019 and the challenge of early refinancing of the country’s medium term debt settlements from 2019, economic analysts said.

Recent experiences have once again displayed the importance of strengthening the economy through structural transformation, while improving the country’s macroeconomic fundamentals, they pointed out.

The postponement of much needed structural reforms will only lead to the Sri Lankan economy lagging behind its regional peers, amidst increased vulnerability to internal and external disturbances, the Central Bank said.

Therefore, it is essential that such reforms are expeditiously implemented within a transparent framework for Sri Lanka to progress as an upper middle income economy where its human and physical resources are fully utilised in a more productive manner.

In this hiatus, there will likely be a limited appetite for pushing ahead with economic reforms. As trade-offs are weighed between reforms and the possibility of an electoral backlash, politicians will be stuck between voter demands for the immediate accrual of benefits, while actual benefits are likely to be felt only after a lag, they emphasized.

For the government, that lag time is narrowing swiftly. In this scenario, the temptation to switch from economic reforms to politics-as-usual will be high.

"We hope that Sri Lanka will be more successful this time around in breaking its pervasive populist cycle to retain the gains on the macroeconomic front, they claimed.

Sri Lanka rupee hits record low of 176.05 on political crisis

The Sri Lankan rupee fell to a record low on Tuesday, as political uncertainty triggered by President Maithripala Sirisena's decision to sack parliament weighed on sentiment, market participants said.

The currency hit 176.05 versus the dollar, surpassing its previous all-time low of 175.90 hit on Monday.

Sirisena dissolved parliament on Friday night and called a general election for Jan. 5, drawing international criticism, in a move likely to deepen the country's political crisis.

"Exporters are not converting dollars and there is a lack of liquidity in the market," one trader told Reuters, asking not to be identified.

The rupee closed at 175.60/75 per dollar on Monday and has fallen 14.6 percent so far this year, Refinitiv Eikon data showed. (Reuters)

Sri Lanka seeks currency swap with Qatar and Oman

Sri Lanka is in talks with Qatar and Oman for foreign exchange swaps, Central Bank Governor Indrajit Coomaraswamy said.

Sri Lanka’s foreign reserves has increased to USD 8 billion with the securing of USD 1 billion foreign currency term financing facility from China Development Bank (CDB), at highly competitive interest rates, Central Bank announced recently.

Sri Lanka is also exploring possibilities of entering into currency swap agreements with trade partners aiming to shore up exports and bring down the trade deficit which is putting pressure on the rupee, he told a forum organized by Asia Securities, a Colombo-based brokering company.

Dr. Coomaraswamy said that inflation was low even though the budget deficit was slightly higher than expected. However, the Governor noted that they would expect a primary surplus.

Sri Lanka dollar bonds drop more than 2 cents as political crisis deepens

Sri Lanka’s dollar-denominated bonds tumbled on today (11) after President Maithripala Sirisena dissolved parliament on Friday night and called a general election for Jan. 5 in a move that will likely deepen the country’s political crisis.

The 2020 issue fell as much as 2.7 cents to 94.98 cents, its lowest level since at least January 2017 with bid yields soaring to record levels of more than 9 percent, according to Refinitiv Eikon data.

Sri Lanka secures USD 1 billion Foreign Currency Term Financing Facility

Sri Lanka Government secured USD 1 Billion Foreign Currency Term Financing Facility, the Central Bank announced.

Proposals from international and domestic banks and investment houses have been entertained for a Foreign Currency Term Financing Facility (FCTFF) denominated in United State Dollar (USD) or Japanese Yen (JPY) or Euro or of their combination up to a limit of USD 1,000 million in March 2018.

Accordingly, four proposals were received from international and domestic banks and investment houses, the Central Bank said.

Through a strict evaluation and negotiation process by a Cabinet appointed Steering Committee and Technical Evaluation Committee, the China Development Bank (CDB) was selected as the syndicate arranger based on least cost and longer maturity period given in its proposal submitted.

Consequently, the Government of Sri Lanka secured USD 1,000 million from CDB under the FCTFF with a maturity period of eight years.

The interest cost is highly competitive and linked to 6 Month USD LIBOR with a grace period of three years. The repayment will be in equal semi-annual payments after the grace period. The resulting inflow increases the official foreign reserves by USD 1,000 million.

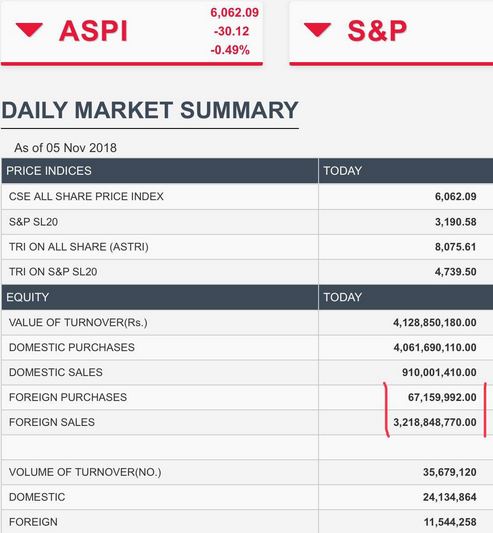

Sri Lankan stock market records heavy foreign outflow: Investors pullout LKR 3.2 billion in a day

The Sri Lankan rupee ended weaker on Monday as outflows from stocks and government securities due to political uncertainty raised dollar demand.

Over LKR 3.2 billion of foreign sales were recorded just today(05).

Finance Minister Mangala Samaraweera in a tweet said that in the 6 days of trading under the Maithri-Mahinda regime, "the net outflow has been a staggering LKR 7 billion - topping the net foreign outflow for the entire year before the 26th of October 2018."

Central Bank strengthens operations to prevent the re-occurrence of bond scams

The Central Bank has taken several measures to strengthen transparency and accountability in several areas of its operations in line with the recommendations of the Presidential Commission of Inquiry to Investigate, Inquire and Report on the Issuance of Treasury Bonds (COI).

Amendments are being formulated with respect to the Monetary Law Act and the Registered Stocks and Securities Ordinance.

Operations relating to the issuance of government securities were strengthened by introducing a new auction system for treasury bonds.A similar system is being formulated for treasury bills as well. Pre-bid meetings are held regularly, the auction calendar is announced in advance and a policy of accepting no more than the total offered amount has been adopted.

Internal controls in relation to the issuance process have been strengthened and the operational manual has also been updated.The fund management function of the Employees’ Provident Fund was strengthened by a new robust Investment Policy Statement, an Investment and Trading Guideline, and an updated operational manual, which are now in place with enhanced internal controls to mitigate risks and improve transparency and accountability.

The legal function is being strengthened with measures to increase resources and the internal audit function has improved its coverage and depth in terms of related risk exposures.

Furthermore, CBSL has introduced a whistle-blowing policy and a code of conduct for all employees.The procurement process for several forensic audits is already underway in several areas such as investments of a fund in equities and treasury bonds, issuance of treasury bonds and certain operations of selected entities regulated and supervised by Central Bank.

The forensic audits are to be conducted by entities with a global practice. Several internal disciplinary proceedings are also underway.

Civil recovery action has been filed to recover unlawful gains made by a Primary Dealer at the expense of funds of the Central Bank and the Employees’ Provident Fund (EPF).

Law enforcement authorities have already initiated action after a complaint was lodge by the Central Bank.

Page 12 of 20