Economic

Sri Lanka to raise up to USD 1.5 Billion through sovereign bonds

Sri Lanka is planning to raise up to $1.5 billion via sovereign bonds, tapping global capital markets for the second time within three months, a government document showed on Thursday.

Government officials said the move was to capitalize on favorable market conditions. It comes nearly six weeks after suicide bombers killed more than 250 people in attacks at churches and luxury hotels on Easter Sunday.

That attack has badly dented the Sri Lankan economy, in particular deterring many thousands of foreign tourists from coming to the island.

“This is mainly to capitalize on the current market conditions which is favorable for us. The bonds we sold in March are now trading below or near the yields they were sold,” a government official told Reuters.

Real time SMS/Email notifications for transactions of Govt. securities

Introducing another feature for the investments and to enhance the awareness of investors in the Government Securities (‘Customers’ of the LankaSecure System), the Central Bank of Sri Lanka which operates and maintains the LankaSecure System has introduced an SMS/ Email Alert Service from 25th March 2019.

The SMS/ Email Alert is a service that sends real-time notifications to investors in Government Securities for each and every movement of scripless securities in Customer’s Securities Account(s). In other words, customers receive a notification (SMSs from “LankaSecure” and emails from “This email address is being protected from spambots. You need JavaScript enabled to view it.”) immediately after a transaction in their Securities Account which is also known as CDS account.

Real-time notifications can either be in the form of an email or a Short Message Service (SMS) or both, based on the customer’s /investor’s preference. To enable the alerts service, custodian institutions (Licensed Commercial Banks or Primary Dealers) are required to record the customer’s /investor’s preferred method of notification, along with relevant contact details in the LankaSecure System.

To ensure registration in the SMS/email alert service, customers are required to contact their custodian institution and submit a written confirmation of their preferred method of notification along with contact details described below;

- a valid email address if the customer wishes to receive the alerts as an email,

- a valid mobile number if the customer wishes to receive the alerts as an SMS

or

- a valid email address and a valid mobile number if the customer wishes to receive the alerts in both email and SMS.

Customers are advised to ascertain that the contents in the alerts are in accordance with the Customer Instructions given to custodian institutions and the agreements between the Customer and the relevant custodian institution.

This SMS/ Email Alert facility is an added service to the regular confirmations sent to customers, as printed statements by the LankaSecure system and the online viewing facility currently available to the investors.

Colombo port container volumes up by 9.1%

The Colombo Port container volumes indicates an increase in the month of April 2019 by 9.1% compared to the same period last year. Together with the Jaya Container Terminal (JCT), South Asia Gateway Terminal (SAGT) and the Colombo International Container Terminal (CICT), the Port of Colombo’s cumulative Volume has increased by 5.9%.

In April 2018 the Colombo Port had handled a total of Transshipments volume of 441,437 TEUs that has increased up to 482,910 for the same period this year. Accordingly, with the increase marked at SLPA and other terminals compared from January to April 2018, the Port of Colombo Transshipment Volumes have marked an increase of 8.6 %. The container throughput at the Sri Lanka Ports Authority (SLPA) controlled terminals has also been increased significantly by 10.5% .

The Port of Colombo is ranked the world’s No.01 container growth port among the top 30 container ports for the year of 2018 in container handling. It has also recorded a 13.5% growth for the year 2018 over the same period of the previous year reaching to 22nd from the position of 23rd amongst global container ports, according to Alphaliner Monthly. It is also a significant achievement as it is the first time in history the Port of Colombo has topped a global maritime ranking. With this growth, Port of Colombo has leapt ahead many other Asian;Middle Eastern and European Ports. The latest release of Drewry Port Connectivity Index also ranked the Port of Colombo as the 11th best Connectivity Port in the world for 2018.

While commending the consistent growth in numbers, Minister of Ports and Shipping Sagala Ratnayaka said the SLPA has also focused on fast-tracking strategic decisions pertaining to the expansion of the Colombo Port’s capacity. “Only such decisions,” the Minister said, “would ensure that our growth is sustainable. The key focus of the SLPA at this point in time is to expedite processes relating to the expansion of the Colombo Port.”

Sri Lanka Ports Authority (SLPA) won the Ports Authority of the Year 2019 Award by the Global Ports Forum (GPF) for the second consecutive year at the GPF awards ceremony 2019.

The relationship between the Management and representative bodies of workers, collaborative support by all parties and the wide engagement of all stakeholders have effectively contributed to the SLPA’s success.

CBSL clarifies allegations raised on the recent issue of ISBs

With reference to the recent paper articles on the governance process and issuing yields relating to the 5-year and 10-year International Sovereign Bonds (ISBs) issued by the Central Bank of Sri Lanka (CBSL) on behalf of the Government of Sri Lanka (GOSL), the CBSL wishes to make the following clarifications:

(a) There has been a clear operational procedure adopted by CBSL for the issuances of ISBs since 2007, involving the Office of the President, the Ministry of Finance (MOF), the Monetary Board of the Central Bank of Sri Lanka, the Cabinet of Ministers, and Hon. Attorney General’s Department.

(b) ISB issuance process is led by a Cabinet appointed Steering Committee (SC) consisting of officials from the MOF and CBSL, supported by a Cabinet appointed Technical Evaluation Committee (TEC) consisting of officials from the MOF and CBSL, and a lead manager or joint lead managers selected based on a competitive evaluation process and duly approved by the Monetary Board and the Cabinet of Ministers. Discussions at SC and TEC are properly minuted and all decisions of SC are subject to the approval of the Monetary Board and the Cabinet of Ministers.

(c) ISBs are issued under the law of the State of New York. In addition to the Hon. Attorney General’s Office, there are two international legal counsels and two local legal counsels appointed with the prior approval of the Cabinet of Ministers in relation to the issuance process. All the documents relating to the issuance of ISB are subject to the prior approval of the said legal counsels and final approval of Hon. Attorney General’s Office.

(d) ISBs are issued at a fixed yield (coupon) rate and at par value. Target yield of the ISB on the issue is arrived by looking at the benchmark risk free rate, the secondary market fair value, new issue premium, prevailing international capital market conditions, other sovereign issuances by emerging and frontier market economies and the yield rates of bonds with similar tenure issued by GOSL, at the time of the issuance of the new ISB. At the announcement of the issuance of a new ISB, an initial yield rate guidance, also known as initial price guidance, is made to the market. The initial yield guidance is made marginally higher than the target yield of the ISB being issued in order to attract investors for the bond being issued and order book building. However, towards the pricing of the ISB, the final yield guidance, usually the targeted yield, is announced and some of the bidders usually withdraw their bids owing to the lower final yield guidance.

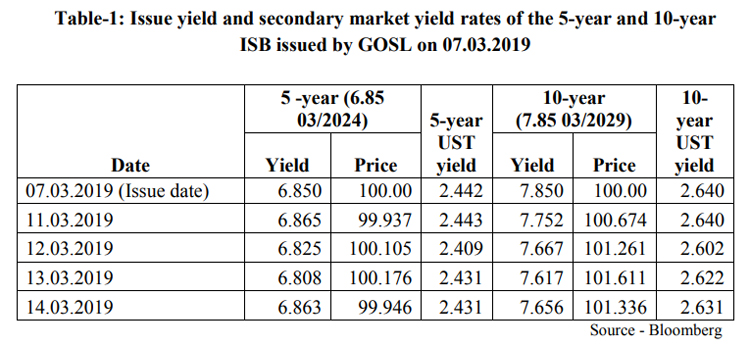

(e) The secondary market transactions of a new ISB commence on the next available trading day, just after the ISB pricing day. If there were no substantial post issue developments affecting the secondary market yield rates in the international bond market, secondary market trading yield would be an indication whether the final yield guidance was fair for both the issuer and the investors. For example, the issuing yields and subsequent secondary market yield rates of the recent 5-year and 10-year ISBs issued by the GOSL up to the date of settlement are tabulated in the Table below.

Sri Lanka raised USD 2.4 billion from international markets on a U.S. dollar-denominated bond offering on March 08, raising hopes of stabilizing and reviving the economy devastated by last-year's 52-day constitutional crisis.

According to a Reuters report, Sri Lanka sold USD 2.4 billion in five-year and 10-year U.S. dollar-denominated bonds on Friday successfully tapping the international markets at a time the country is facing strains on its finances.

Sri Lanka's tea exports to China records sharp rise

Sri Lanka's black and green tea exports to China has risen sharply so far this year with Chinese youth acquiring a taste for Sri Lanka's popular Ceylon tea, Sri Lanka Tea Board Chairman Lucille Wijewardena said here Wednesday.

In an interview with local media EconomyNext, Wijewardena said that in the first quarter of this year, almost 2.8 million kg of Ceylon tea were exported to China, up 210,300 kg or 8.2 percent from a year ago.

"These numbers are huge. And this is a great opportunity for our industry as we are now open to a market with the highest population in the world," Wijewardena said.

Wijewardena attributed the surge in tea exports to China mainly to Chinese youth developing a liking for consuming black tea with milk.

China was the seventh highest export market for "Ceylon tea" in March this year, ahead of other key markets like Syria, Germany and Japan.

He added that Sri Lankan tea carries a premium quality image, which attracts higher demand and global recognition.

Sri Lanka's Plantation Industries Minister Navin Dissanayake said in February that a mega global campaign would be launched this year to promote Ceylon Tea in order to boost the island's tea exports.

The global campaign will first start off in China and then in Russia, Germany, Ukraine and Japan.

Sri Lanka earned an estimated 1.43 billion U.S. dollars in 2018 through its tea exports.

Dissanayake said that with a better year expected for the tea industry, the government was targeting a revenue of 1.60 billion U.S. dollars from its tea exports in 2019.

(Xinhua)

Fitch Assigns Sri Lanka's USD Bonds Final 'B' Rating

Fitch Ratings announced to day that they have assigned a final rating of ‘B’ to the following bonds issued by Sri Lanka on 7 March 2019.

Accordingly, USD 1 billion 6.85% bond due in 2024, and USD1.4 billion 7.85% bond due in 2029.

This rating has replaced the expected rating of 'B (EXP)' that Fitch assigned on 6 March 2019.

KEY RATING DRIVERS

The ratings are in line with Sri Lanka's Long-Term Foreign-Currency Issuer Default Rating (IDR) of 'B' with a Stable Outlook.

RATING SENSITIVITIES

The ratings would be sensitive to any changes in Sri Lanka's Long-Term Foreign-Currency IDR. Fitch downgraded Sri Lanka's Long-Term Foreign- and Local-Currency IDRs to 'B' from 'B+', with a Stable Outlook, on 3 December 2018.

IMF commends Sri Lanka's efforts to advance fiscal consolidation

The Sri Lankan authorities have made progress to bring the Extended Fund Facility (EFF) program, under the International Monetary Fund (IMF), on track, despite 2018 being a tough year and IMF commends the measures taken to improve security with a sustained effort by all parties to improve monetary, policy and market stability to achieve higher growth following the terrorist attacks, said IMF Mission Chief for Sri Lanka, Manuela Goretti via a video conference from Washington last week.

Speaking to journalists at the IMF office in Colombo, the Mission Chief commended the efforts by Sri Lanka to advance fiscal consolidation through the well-targeted 2019 Budget.

She also commended efforts to rebuild reserves while maintaining a prudent monetary policy under greater exchange rate flexibility.

“Inflation remains anchored with prudent monetary policy management by the Central Bank,” Goretti said.

However, with regard to the implications of the recent terrorist attacks on the economy, the Mission declined to comment as it felt it is too early to assess the implication of the attacks on the economy. “It would be speculating to make assumptions at this point of time. However, we will be monitoring the situation in Sri Lanka,” the Mission Chief said while noting that meeting revenue targets will be critical as tourism, a key sector of the economy has been affected by the recent incidents.

However, according to the Mission Chief, the IMF will maintain its growth projection of 3.5 percent for Sri Lanka this year and thereafter, five percent in the medium term.

On the implications of the Easter attacks on other sectors, she said along with tourism, investor and market confidence too has been impacted negatively. The authorities need to stabilise the economy soon.

When queried about Sri Lanka’s refinancing position following the attacks, given the low ratings on the country, the Mission Chief noted that there was no major risk for Sri Lanka in refinancing as the country has successfully financed two large bonds. There is one coming in October next year. Sri Lanka is open to international capital markets.

country, the Mission Chief noted that there was no major risk for Sri Lanka in refinancing as the country has successfully financed two large bonds. There is one coming in October next year. Sri Lanka is open to international capital markets.

The global lender revised down its global growth forecast for 2019 to 3.3 percent from the previous level of 3.5 percent in its latest World Economic Outlook (WEO) as the trade war between the US and China, US sanctions on Iran and political instability across countries continue to weigh in heavily on the global economy.

When asked whether such headwinds would impact Sri Lanka’s growth, the Mission Chief said the slow down in international trade will be a loss for every economy. However, there is no immediate threat to Sri Lanka, in particular, from trade wars. Sri Lanka has already started to liberalise trade to be more competitive in international markets.

On the additional time offered to Sri Lanka, Goretti said an additional year was offered to Sri Lanka to complete the program supported by the IMF which remains broadly the same,” Goretti said. The Executive Board also approved an extension of the arrangement by one additional year, until June 2, 2020, with re-phasing of remaining disbursements.

Lanka could be taken off money laundering watch list - IMF

Sri Lanka could be taken off the Financial Action Task Force’s (FATF) ‘grey list’ of countries deemed not compliant enough with global rules to prevent money laundering and terrorist financing by the middle of this year, according to a report by the International Monetary Fund (IMF).

A team from the FATF, an intergovernmental organisation to combat money laundering and terrorist financing, is due to visit Sri Lanka this month, an IMF statement said.

The team will check Sri Lanka’s compliance with global Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) rules.

The FATF placed Sri Lanka under monitoring status, or a grey list, in 2017 saying there were strategic deficiencies in its compliance.

Earlier this year, Central Bank Governor, Dr. Indrajit Coomaraswamy said that Sri Lanka has recorded considerable progress in completing the Action Plan agreed with the FATF. “The Central Bank has taken steps to strengthen the national Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) policy framework of the country. We have also expanded our reach by way of entering into a Memoranda of Understanding with several agencies such as the Securities and Exchange Commission, Insurance Regulatory Commission and the Department of Motor Traffic. Several progressive policies will be adopted with the coordination of all stakeholders to deepen financial intelligence services,” he said in January.

The latest IMF statement said Sri Lanka has taken measures to strengthen the Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) regime of the country.

“It is expected that Sri Lanka will be able to exit the ‘Grey List’ during the second half of 2019,” it said.

The IMF statement said, the authorities, in coordination of other stakeholders, are actively working towards successful completion of the time-bound action plan provided to Sri Lanka to address the strategic deficiencies identified in AML/CFT activities by the Financial Action Task Force (FATF).

Fitch Ratings to recalibrate Sri Lanka National Rating Scale

Fitch Ratings in statement on Monday said that they will recalibrate the Sri Lankan National Rating scale to reflect changes in the relative creditworthiness among Sri Lankan issuers following the downgrade of the country's sovereign rating to 'B' from 'B+' on 3 December 2018.

The recalibration will result in rating actions for some issuers with Sri Lankan national ratings. We anticipate a reduction in the number of 'AAA(lka)' rated issuers after the recalibration exercise is finalised, expected by end-February 2019, as a result of the sovereign downgrade and the resultant changes to the relative ranking of credits in the country.

National scale ratings are a risk ranking of issuers in a particular market designed to help local investors differentiate risk. Sri Lanka's national scale ratings are denoted by the unique identifier '(lka)'. Fitch adds this identifier to reflect the unique nature of the Sri Lankan national scale.

National scales are not comparable with Fitch's international ratings scales or with other countries' national rating scales.

$70 million form World Bank to strengthen 134 local govt. authorities

The International Development Association (IDA) of the World Bank has provided a loan facility of USD 70 million to strengthen the service provide by 134 Local Authorities in the Northern, Eastern, North Central and Uva Provinces under the Local Development Support Project (LDSP), the Finance MInistry announced.

The Loan Agreement was signed on Tuesday (14), at the Ministry of Finance by Dr. R H S Samaratunga, Secretary, Ministry of Finance and Idah Z Pswarayi – Riddihough, World Bank Country Director for Sri Lanka and Maldives.

This development support project is designed to strengthen local authorities’ capabilities to deliver services to communities in a responsive and accountable manner and to support economic infrastructure development in participating provinces by Strengthening Local Government Planning Systems, Improving Local Services and Economic Infrastructure and Institutional Development etc.

The Government had requested the World Bank Group to provide financial assistance to implement the above priority, for which the International Development Association (IDA) of the World Bank has shown their interest to mobilize its funds through a credit of United States Dollars 70 million. Total estimated cost is approximately USD 100 million, out of which IDA credit is USD 70 million and the government will contribute USD 7 million with the balance being financed by the European Union (EU) through a grant.

A spokesperson for the Finance Ministry said that the overall responsibility of the implementation of this project lies with the Ministry of Provincial Councils, Local Government and Sports.

Sri Lanka's trade deficit narrows significantly

Sri Lanka continued to perform moderately in merchandise exports as the country recorded gains in exports during the month of November last year while the deficit in the trade account narrowed significantly (year-on-year) following the noteworthy decline in the import expenditure, Central Bank announced.

The latest data released by the country’s monetary regulator showed earnings from merchandise exports increased moderately by 4.1 per cent (year-on-year) to US dollars 980 million in November 2018. Expenditure on merchandise imports declined by 9.1 per cent (year-on-year) for the first time since June 2017 to US dollars 1,765 million in the same month narrowing the trade deficit. Exports grew by 4.1 per cent while imports contracted by 9.1 per cent in November 2018 (year-on-year).

The decline in consumer and investment goods contributed to the drop in import expenditure reflecting mainly the impact of restrictions on personal vehicles and non-essential consumer goods imports

The relatively larger depreciation of the Sri Lankan rupee may also have contributed to curtailing imports, Central Bank said. The growth in exports was driven by industrial exports while agricultural exports continued to decline.

Under industrial exports, export earnings from textiles and garments increased notably in November 2018 mainly driven by exports to the USA.

In addition, garment exports to non-traditional markets such as India, Canada and Australia as well as the EU market increased along with textile and other readymade garments.

Earnings from petroleum products increased significantly during the period under review reflecting higher bunker and aviation fuel prices despite a slight reduction in export volumes in comparison to that of November 2017.

Export earnings from machinery and mechanical appliances food, beverages and tobacco, rubber products and base metals and articles rose in November 2018.

However, export earnings from printing industry products, gems, diamonds and jewellery and leather products, travel goods and footwear declined.

CBSL to reduce lending rates to help SME sector

The Central Bank of Sri Lanka has observed high interest rates charged on lending products and excessively high interest rates offered on deposit products by licensed commercial banks and licensed specialized banks (licensed banks) and Non-Bank Financial Institutions (NBFIs) despite the measures taken to bring down overnight interest rates and enhance market liquidity through the reduction of Statutory Reserve Ratio (SRR). Especially in the context of well contained inflation and inflation expectations, Sri Lanka’s interest rates in real terms also have been found to be excessive in comparison to other regional economies.

Accordingly, the Central Bank has requested licensed banks and NBFIs to reduce interest rates on deposits to accelerate monetary policy transmission through the financial sector, enabling licensed banks to reduce their interest rates on lending products in general, and to SMEs in particular, and thereby enhance credit flows to the real economy.

Interest rates on Savings and other deposits with tenures less than 3 months offered by licensed banks and NBFIs will be linked to the Standing Deposit Facility Rate (SDFR) whilst longer tenures will be linked to the 364 day Treasury bill rate. Licensed banks and NBFIs may offer an additional interest rate up to 50 basis points for savings deposits of children under the age of 18 years, and for Fixed Deposits (FD) of senior citizens with tenure of 01 year or more. Debt instruments issued by NBFIs will also be subject to maximum interest rates. In spite of these measures, interest rates on deposits are expected to remain competitive, providing a substantial real return to depositors.

Through the above measures, that would reduce excessive cost of funds borne by the financial sector, the Central Bank expects the lending rates to reduce by around 200 basis points to SMEs in the near term. The reduction in SRR by 250 basis points in two steps in November 2018 and March 2019 has already reduced cost of funds and is expected to result in a narrower margin between deposit and lending rates.

The Central Bank will closely monitor the behaviour of interest rates of licensed banks and NBFIs on both deposits and loans and take further measures as appropriate in future.

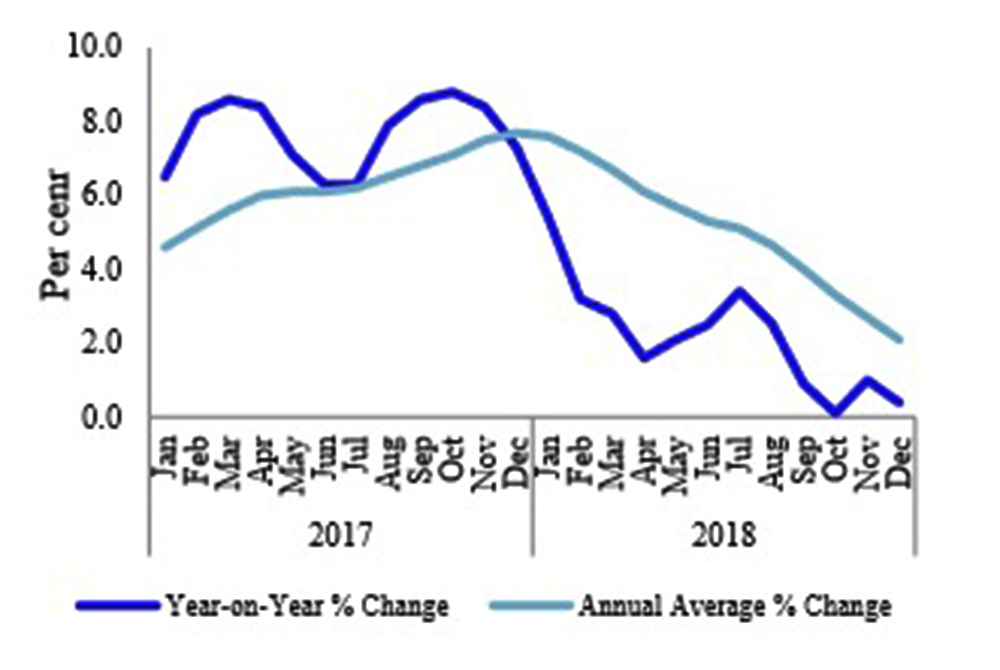

Sri Lanka’s inflation trends down in December

Sri Lanka’s prices of food and non-food items have come down in December last year, Central Bank announced on Monday releasing last month’s head line inflation report.

A street opinion poll however, revealed that everybody is cutting back on their spending with the the lower middle class and the poor struggling to make ends meet.

Analysts say that food prices often change at a greater rate than overall inflation.

Food prices tend to be more volatile because they are determined by factors, such as the weather. Also, with inelastic supply and demand, this makes prices more volatile, they added.

Headline inflation as measured by the year-on-year change in the National Consumer Price Index (NCPI, 2013=100)1 decreased to 0.4 percent in December 2018 from 1.0 percent in November 2018.

The decrease observed in year-on-year inflation in December 2018 is driven by the decrease of prices of items in both Food and Non-food categories, Central Bank said.

Year-on-year food inflation decreased to -4.5 percent in December 2018 from -3.9 per cent in November 2018 while year-on-year Non-food inflation also decreased from 5.2 percent in November 2018 to 4.7 percent in December 2018.

The change in the NCPI measured on an annual average basis decreased to 2.1 per cent in December 2018 from 2.7 per cent in November 2018.

The month on month change of the NCPI was -0.5 per cent in December 2018. This was mainly due to decrease in the prices of the items in the Non-Food category where Transport sub-category (Petrol, Diesel and Bus fare) recorded the highest decrease.

Moreover, prices of items in the Communication; and Alcoholic Beverages and Tobacco sub-categories also reported decreases during the month.

At the same time, prices of items in the food category decreased where vegetables, limes, big onions, bananas and coconuts recorded prominent decreases.

The core inflation, which reflects the underlying inflation in the economy, remained at 3.1 percent in December 2018 on year-on-year basis. Meanwhile, annual average core inflation also remained unchanged at 2.4 percent in December 2018.

Page 10 of 20