Oil prices look set to temporarily hit $90 a barrel during the first half of next year, if not sooner, and risk spiking to as much as $100 a barrel, depending on geopolitical events and other factors, say Bank of America Merrill Lynch analysts.

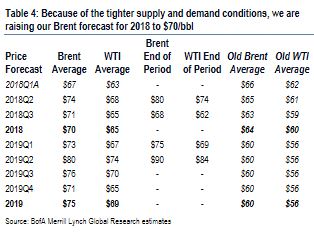

But they do not see an immediate major jump in prices. For this year, they forecast an average price of $70 a barrel for Brent crude, the international benchmark. They forecast $75 for next year. Their previous forecast was $60.

Prices could climb significantly next year, however. The analysts have a target of $90 a barrel during the second quarter of 2019, with a risk it could go to $100 a barrel. Futures on Brent were trading as high as $78 Thursday.

"Looking into the next 18 months, we expect global oil supply and demand balances to tighten driven by the ongoing collapse in Venezuelan output. In addition, there are downside risks to Iranian crude oil exports. Plus we see a high likelihood of OPEC working with Russia in 2019 to set a floor on oil prices," they wrote.  The report says OPEC and Russia could gradually reduce the amount of oil they are holding off the market by 450,000 barrels a day next year. But if they do not step back from their current agreement to withhold 1.8 million barrels a day, the market will get tighter and prices will be higher.

The report says OPEC and Russia could gradually reduce the amount of oil they are holding off the market by 450,000 barrels a day next year. But if they do not step back from their current agreement to withhold 1.8 million barrels a day, the market will get tighter and prices will be higher.

They also expect Venezuela's output to drop by 500,000 barrels a day over the next 20 months, but they did not include a major drop in Iranian exports in their forecast. If a new nuclear deal is not reached within six months, global oil markets could tighten further. They factored in Iran's current production of about 3.8 million barrels a day.

As for the U.S., they forecast West Texas Intermediate crude prices will be about $5 below Brent this year and $6 below next year, due to bottlenecks in transporting shale crude to market and because of capital constraints at drillers. WTI was trading just above $71 a barrel on Thursday.

Infrastructure limitations in the U.S., such as the lack of pipeline capacity, means shale drillers may not ramp up as much production as they otherwise might. The analysts expect some of those issues involving long-haul pipelines to be solved in the second half of 2019. They also see U.S. drilling constrained by pressure on companies to exercise capital discipline in the face of rising costs.

World oil consumption should grow by 1.5 million barrels a day this year and 1.4 million barrels a day next year.

OPEC and Russia cut back on output beginning in 2016 because of a massive supply glut. Bank of America now sees a deficit of 630,000 barrels a day this year and 300,000 next year. They expect that will drive down OECD oil stocks below their five-year average, a metric watched by OPEC and Russia as they monitor the progress of their production agreement to balance supply and support prices.

Leave your comments

Login to post a comment

Post comment as a guest