It has been revealed that Sri Lanka’s income tax rates and corporate tax rates are well below than that of many regional peers. Dispelling allegations made by Joint Opposition MPs that Sri Lanka is burdened with heavy tax rates, officials of the Ministry of Finance said that Sri Lanka has a relatively low tax rate compared to that of neighbouring countries such as India and Pakistan.

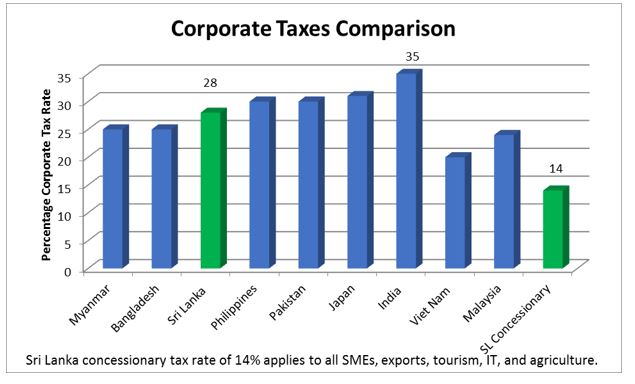

Corporate Tax Rates

According to data received from the Treasury, Sri Lanka’s upper end corporate tax rate of 28% is below than the tax rates imposed in Pakistan, Japan, India and Philippines.

Finance Minister Mangala Samaraweera had made arrangements to introduce a special concessionary corporate tax rate of 14% for all small and medium scale enterprises that record an annual turnover of less than LKR 500 million.

This special concessionary tax rate was also extended towards all export companies as well as businesses engaged in the agriculture, tourism and IT sectors.

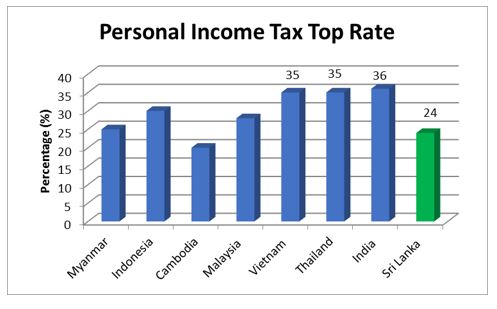

With the exception of Myanmar and Cambodia, Sri Lanka’s personal income tax top rate of 24% is well below than other countries in the region.

For example, India has imposed a top tax rate of 36% while Vietnam and Thailand have set their top rates at 35%. Malaysia and Indonesia too have higher personal income tax rates than Sri Lanka, the Finance Ministry official said.

At a press conference held at the Finance Ministry past Thursday (07), Samaraweera said that the masses should not always complain about taxes.

“Taxes are essential for a country. In Sri Lanka, around 82% of taxes are indirect, one of the highest rates in the world. We only have about 246,000 tax files. For a population of 20 million, we should have at least one million income tax files. This needs to change”, he said.

Finance Ministry officials pointed out that with the implementation of the new IRA Act in 2018, Finance Minister Samaraweera is trying to reduce the indirect tax rate of 82% which is primarily borne by ordinary people, by widening the tax net to include more direct tax payers.

Leave your comments

Login to post a comment

Post comment as a guest