As a result of the illegal and unconstitutional coup, led by President Maithripala Sirisena, Sri Lanka’s economy has been placed in great peril. The uncertainty created has triggered an immediate negative impact at a time of tremendous fragility in global financial markets.

Financial analysts point pout that Foreign investors have rapidly sold out of Sri Lanka's stock market and debt markets. In just weeks of the illegal regime Rs. 28.8 billion (US$ 165 million) was withdrawn by foreign investors as they lost confidence in economic management of the regime.

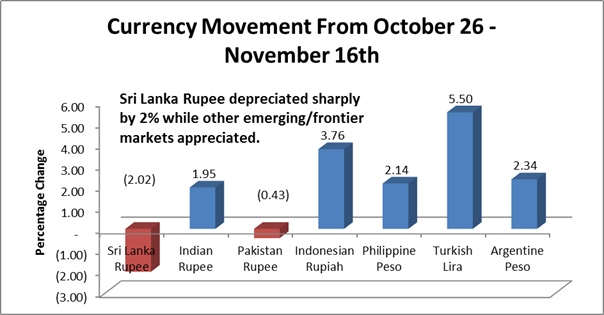

As a result of this money going out of the economy there was major depreciation pressure on the Rupee. Whilst previously the Rupee was facing pressure due to international factors that affected all emerging/frontier economies - this time the depreciation is an entirely domestic issue due to the irresponsible actions of the illegal regime.

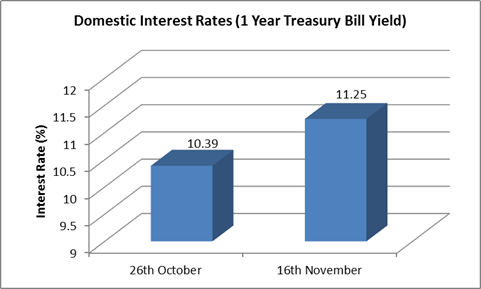

Furthermore, The illegal regime has tried to defend the rupee by selling down our valuable reserves resulting in a liquidity crunch in the domestic market causing interest rates to shoot up in the last 3 weeks - this will lead to higher borrowing costs for individuals and businesses, hurting investment, economic growth.

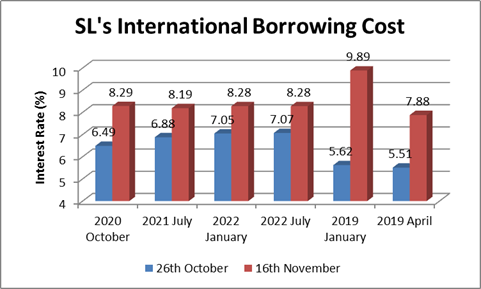

The cavaliar economic management by the illegal regime has also resulted in a sharp increase in Sri Lanka's external borrowing costs as risks of investment in Sri Lanka has increased. This will make it significantly more expensive to refinance the large debt servicing of up to US$ 15 billion that Sri Lanka needs to refinance in the next 3 years. These costs will all be faced by the public.

The range of tax cuts made by the illegal government will severely undermine government revenue, analysts pointed out. It is not clear as to how this illegal administration expects to reduce government expenditure in order to balance the budget after these erratic, irresponsible, and populist tax cuts.

In the first 6 months of 2018, total revenue was Rs. 925 billion. Expenditure on salaries and wages was Rs. 316 billion, interest payments Rs. 391 billion, welfare Rs. 223 billion. These 3 items alone add up to Rs. 930 billion. Will Mahinda Rajapaksa reduce the size of the public service? Will he cut salaries? Perhaps he will reduce pensions?

The irresponsible measures since the illegal takeover of government by the former strongman and purported minister of finance and economic policies Rajapaksa have gone against the basic principles of economic management.

The irresponsible measures since the illegal takeover of government by the former strongman and purported minister of finance and economic policies Rajapaksa have gone against the basic principles of economic management.

These short-term, cheap, populist measures are an attempt to deceive the public to capture political power and avert impending court cases, whilst putting the country risk of major economic peril.

Leave your comments

Login to post a comment

Post comment as a guest