The illegal regime has created political turmoil by changing a government without an election, and compounded matters by announcing unsustainable, populist policy measures at a time of global economic turbulence. As a result, there has been a rapid outflow of US$ 84 billion from our debt and equity markets in just one week.

This illegal regime is setting the country up for a Balance of Payments crisis by selling down reserves to defend the value of the Rupee. It would be instructive to remind ourselves how they tackled previous experiences of such crises.

The first balance of payments crisis they faced started in the second half of 2011. In fact in the budget of November 2011, it was probably the first time in modern history anywhere in the world, that a budget speech announced a forced depreciation of the rupee – an issue that ought to be the realm of the Central Bank’s monetary policy.

The Central Bank continued to stubbornly defend the rupee by selling down valuable foreign reserves to the tune of US$ 4.1 billion. They also imposed a credit ceiling of 18% on all banks in 2012. Interest rates (PLR) shot up from 10.7% to 14.4% between end 2011 and end 2012. What was the net result? The currency crashed from Rs. 113.90 in end 2011 to Rs. 132.55 by end April 2012 along with higher interest rates and a permanent loss of valuable reserves.

But this was not the only measure taken by the government at that time. Let us refresh our memories.

- ·01 January 2011 - Average electricity tariff was increased by 8 per cent.

- ·01 March 2011 - The minimum purchase price of fresh milk at farmgate was increased to Rs.50 per litre from Rs.35 per litre.

- ·02 April 2011 - The retail price of petroleum products were increased as follows: -

Petrol by Rs.10 to Rs.125 per litre

Diesel by Rs.3 to Rs.76 per litre

Kerosene by Rs.10 to Rs.61 per litre

- ·The price of a 12.5 kg cylinder of LP gas was increased by Rs.238 to Rs. 1,890.

- ·03 May 2011 - The maximum retail price of a 400 gram full cream milk powder packet was increased by Rs.20 to Rs.264 and the maximum retail price of a 1 kg full cream milk powder packet was increased by Rs.49 to Rs.647.

- ·20 August 2011 - The price of a 12.5 kg cylinder of LP gas was increased by Rs.156 to Rs.2,046.

- ·30 October 2011 - The retail price of petroleum products were increased as follows: -

Petrol by Rs.12 to Rs.137 per litre

Diesel by Rs.8 to Rs.84 per litre

Kerosene by Rs.10 to Rs.71 per litre

The fun continued in 2012.

- ·12 February 2012 - The retail price of petroleum products were increased as follows: -

Petrol by Rs.12 to Rs.149 per litre

Diesel by Rs.31 to Rs.115 per litre

Kerosene by Rs.35 to Rs.106 per litre

- ·14 February 2012 - Passenger bus fares were increased by an overall average of 20 per cent.

- ·16 February 2012 - A Fuel Adjustment Charge (FAC) was imposed on the monthly electricity bill at the following rates:

Domestic Consumers 0 - 30 (units/month) 25%

31- 60 (units/month) 35%

Above 60 (units/month) 40%

Industries 15% Hotels 15% General Purpose 25%

- ·04 May 2012 - The maximum retail price of a 400 g full cream milk powder packet was increased by Rs. 61 to Rs. 325 and the maximum retail price of a 1 kg full cream milk powder packet was increased by Rs. 163 to Rs. 810.

- ·The price of a 12.5 kg cylinder of LP gas was increased by Rs. 350 to Rs. 2,396.

- ·01 October 2012 - Water tariffs of domestic consumers were revised upward by an average of 60 per cent.

- ·15 December 2012 - The retail price of petrol was increased by Rs.10 to Rs. 159 per litre.

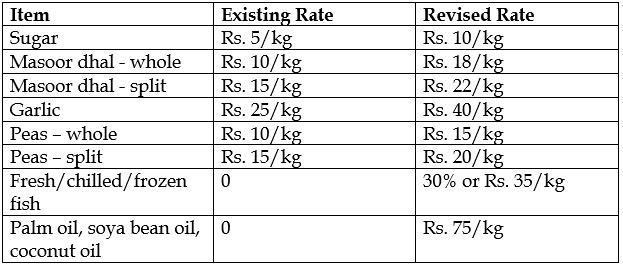

- ·13 January 2012 - Special Commodity Levy (SCL) on the importation of the following food items was increased /imposed for a period of four months.

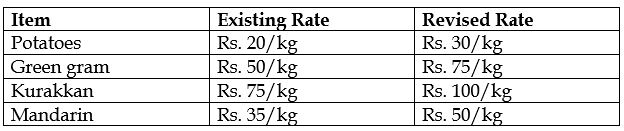

- ·22 March 2012 - SCL on the importation of the following food items was increased for a period of nine months.

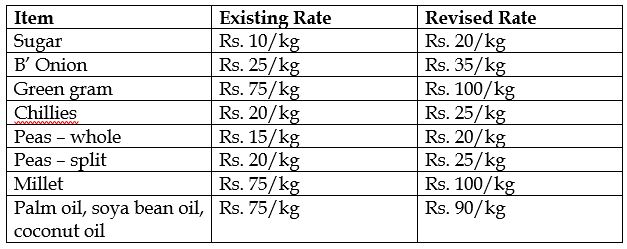

- ·12 May 2012 - SCL on the importation of the following food items was increased for a period of nine months.

All of the above data is from the Central Bank Annual Reports of 2011 and 2012.

In spite of all of these burdens imposed by the government of 2012 on our citizens – the rupee depreciated by 14% in a period of 4 months in early 2012. All of this also took place when global interest rates were low – LIBOR was around 0.5%. Today it has increased by 6 fold – emerging and frontier markets are facing tremendous volatility.

The public would be wise to not be fooled by the cheap, myopic, populist pronouncements on taxes and prices – let us remind ourselves of what is in store for us if this illegal regime continues in power – it will be infinitely worse than what they imposed in 2012.

Leave your comments

Login to post a comment

Post comment as a guest