Sri Lanka’s Central Bank on Monday refuted a report that the island nation was at risk of an impending currency crisis.

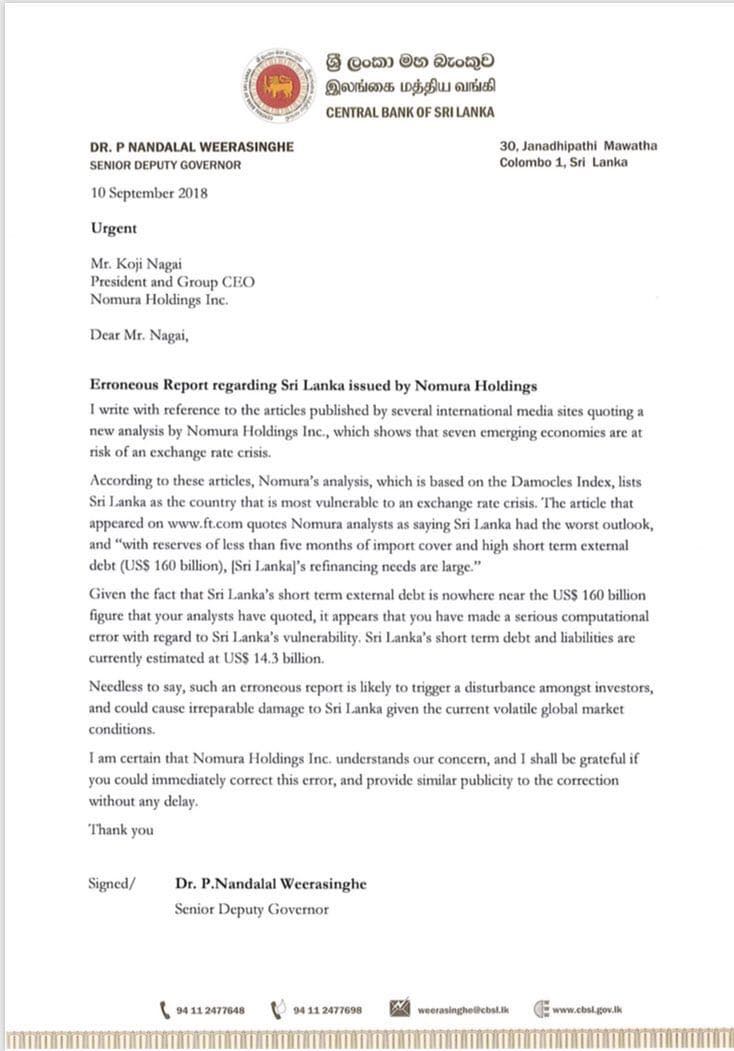

In a report compiled by Nomura Holdings Inc. Sri Lanka, South Africa, Argentina, Pakistan, Egypt, Turkey and Ukraine were identified as countries most at risk with Sri Lanka being described as having the worst outlook “due to still-weak fiscal finances and a very fragile external position”. Senior Deputy Governor of the Central Bank of Sri Lanka, Dr. P. Nandalal Weerasinghe pointed out a serious anomaly in the Nomura report. He stated that Sri Lanka’s debt is nowhere near the US $ 160 billion figure quoted by Nomura.

Dr. Weerasinghe also pointed out that the actual figure is estimated at US $ 14.3 billion.

"Given the fact that Sri Lanka’s short term external debt is nowhere near the US$ 160 billion figure that Nomura analysts have quoted, it appears that Nomura Holdings have made a serious computational error with regard to Sri Lanka’s external vulnerability,” Dr. Weerasinghe said.

“As such an erroneous report could to trigger an unwarranted panic amongst investors, particularly in the context of current volatile global market conditions, the Central Bank of Sri Lanka has already written to Nomura Holdings, and requested them to correct this error without any delay.”

Leave your comments

Login to post a comment

Post comment as a guest