Business

Ikea founder Kamprad dies at 91

The Swedish founder of the Ikea furniture chain, Ingvar Kamprad, has died at the age of 91, the company has announced.

Mr Kamprad died at his home in Småland, Ikea confirmed in a statement.

The company said that Mr Kamprad was "one of the greatest entrepreneurs of the 20th century".

The Ikea founder had faced questions over his past links to the Nazis, which he referred to as the "greatest mistake" of his life.

Source : BBC News

Respected Sri Lankan Business leader, D. Eassuwaren no more!

Respected Sri Lankan Business leader, D. Eassuwaren who was the Chairman of the famed Eswaran Brothers (Pvt) Ltd., a premier tea supplier and exporter of various other products in the country passed away yesterday (Saturday) in Singapore.

D. Eassuwaren was the eldest son of the Late V.T.V. Deivanayagam Pillai, a well- known philanthropist and founder of Eswaran Brothers and the V.T.V Deivanayagam Pillai group of Companies & the late Mrs Sithambrathammal Deivanayagam Pillai.

A product of St. Benedict's College in Kotahena, he pursued his higher studies in India. At the time of his death, Mr Eassuwaren was a father of two sons and two daughters.

In March 2017, D.Eassuwaren received the Deshabandu national award from President Maithripala Sirisena.

He had set up his first business to export tea and other Sri Lankan produce with the initiation by his father, V. T. V. Deivanayagam. Eswaran Brothers established their humble beginnings in 1964 with their first export of 300 chests of tea to Somalia.

D. Eassuwaren was also a philanthropist much alike his father providing facilities to less privileged schools, contributing to the construction of the 70 feet tall Samadhi Buddha statue in Rambadagalla, financially supporting rehabilitated former LTTE cadres to marry and working towards ensuring a sustainable tea business while protecting the environment.

Eassuwaren held many important posts during his lifetime and was a former President of the National Chamber of Commerce, former Honorary Consul of the Republic of Mauritius, Trustee of the Varatharaja Vinayaga Temple, Former President of the Kanban Kalagam Literary Association, Trustee of the Manitha Neyam Trust among many others.

The mortal remains of D. Eassuwaren will be brought to the country at 2 pm today and will lie at No. 133, New Chetty Street, Colombo 13.

Source : Sunday Observer

SriLankan Chief Ratwatte given marching orders

SriLankan Airlines CEO Suren Ratwatte was asked to step down following a Board meeting on Thursday. According to government officials, Manoj Gunawardena is tipped to be the hot favourite to take over from Ratawatte.

The move comes amidst plans to restructure the troubled national carrier, with its Chairman and Board of Directors expected to step down once the Government finalises the reform agenda.

When asked about the changes, a member of the Board said: “decisions on restructuring and changes in personnel need the approval of the ministerial committee under the Prime Minister which includes the line Minister.”

The appointment will be finalised during next week’s board meeting upon Company Chairman Ajit Dias’ return to the country.

SriLankan Airline employee unions had repeatedly called for Ratwatte’s removal from the post amidst claims that he was unable to keep the cash-strapped airline from taking a nosedive. The Unions were receptive to the possibility of Guwardene’s appointment.

Krishan Balendra appointed Deputy Chairman at JKH

John Keells Holdings Plc yesterday announced that Krishan Balendra has been appointed as the Deputy Chairman, ahead of him taking over as the Chairman from 1 January 2019.

The move follows Ajit Gunewardene retiring as Deputy Chairman with effect from 31 December 2017 and the impending retirement of incumbent Chairman Susantha Ratnayake with effect from 31 December 2018.

JKH also announced the appointment of Gihan Cooray as the Group Finance Director with effect from 1 January 2018 succeeding Ronnie Peiris who retired on 31 December 2017. Cooray will be the Deputy Chairman from 1 January 2019 after Balendra assumes Chairmanship.

Source : Daily FT

Softlogic to raise Rs. 7 bn with foreign equity investments up to USD 35 mn

Softlogic Holdings PLC came to an agreement with Samena Ceylon Holdings Limited to raise private equity in order to restructure Company balance sheet and improve key capital ratios.

Samena Ceylon Holdings is a fully owned subsidiary of Samena Capital, a principal investment group focusing on the Subcontinent, Asia, Middle East and North Africa.

The firm has raised more than USD 1.5 billion of capital since 2008 and has returned USD 615 million to investors from over 45 full and partial exits. Samena Capital currently manages total capital of approximately USD 1 billion across three primary investment strategies: private equity, direct investments, and credit.

This will be Samena Capital first investment in Sri Lanka and its fourth investment in the Asian region within the past six months.

The private placement of 182.7 million ordinary shares at Rs. 17 per share raises Rs. 3.11 billion for Softlogic Holdings PLC to be utilized to settle short-term debt. Subsequently, Samena Capital will hold 19% of the Company.

A further issue of 230.81Mn shares by way of rights issue in the proportion of 24:100 at Rs. 17.00 per share will be made to raise Rs. 3.9 billion.

Softlogic Holdings PLC’s present stated capital stands at Rs. 5,089 million with 779 million shares in issue. Subsequent to the private placement and rights issue, the stated capital would rise to Rs. 12,119 million with 1,192.5 million shares.

Softlogic Holdings PLC has been investing in strategic CAPEX projects with a long term view.

This fund-raising exercise which raises over Rs. 7 billion will help the Company rectify the funding mismatch and, in turn, boost profitability with noticeable saving in finance costs when equity replacesdebt.

Ashok Pathirage – Chairman/ Managing Director of Softlogic Group, said, “Samena brings in a wealth of global business expertise and access to quality financing. With this equity infusion, Softlogic’s financial position will be strengthened, propelling strong bottom line and supporting medium term investments.”

Shirish Saraf, Founder & Vice Chairman of Samena Capital, said, “We are delighted about our first investment in Sri Lanka and to partner with Ashok Pathirage in Softlogic Holdings. We strongly believe Sri Lanka is one of the most exciting markets in the Samena region and our investment reflects our confidence in the Softlogic Group.

We see multiple growth drivers for each of the businesses and look forward to actively supporting the Softlogic team in their endeavour of building a truly world class enterprise.”

This fund-raising exercise is subject to regulatory approvals and shareholder approval at a General Meeting.

CBSL to manage ETI Finance and Swarnamahal FS

The Monetary Board of the Central Bank of Sri Lanka at its meeting held on January 1, having considered the weak financial performances of the ETI Finance Ltd. (ETIF) and Swarnamahal Financial Services PLC (SFSP) decided to take regulatory actions, as a temporary measure, under the provisions of the Finance Business Act No. 42 of 2011, with immediate effect.

This with a view to safeguard the interests of the depositors and other creditors of the two companies, and to ensure safety and soundness of the financial system.

These include the appointing a panel to manage the affairs of both companies restrict the withdrawal of maturing deposits and renew such deposits for a period of six months and thirdly the payment of interest due for deposits as per agreed terms and conditions.

In the meantime, the companies can finalize the negotiations with the prospective investors and the Central Bank will facilitate suitable investors as per the applicable laws and regulations.

The depositors of the above two companies are further informed that the Central Bank is taking further measures and closely monitoring the operations of the companies to protect the rights of the depositors and therefore, the depositors are kindly requested to cooperate with the Central Bank in its effort to ensure the stability of the ETIF and SFSP.

The depositors may contact the Department of Supervision on Non-Bank Financial Institutions of the Central Bank through the telephone numbers 011 2477258 or 011 2477229, for further clarification.

Source : Daily News

Hemas buys Atlas for Rs. 5.7 Billion

Hemas Holdings PLC said yesterday it acquired 75.1% of Atlas Axillia Co Ltd, Sri Lanka’s leading school and office brand, for a consideration of Rs. 5.7 billion. The existing shareholders of Atlas will retain a stake of 24.9% in the company, post-acquisition.

Atlas Axillia Managing Director Nirmal Madanayake said: “Atlas Axillia is on a great journey of growth and we were keen to take our organisation to the next level. We went through a rigorous process to find the right partner, and we saw a great business and cultural fit with Hemas. “

“Both our organisations have a rich history of bringing loved brands to Sri Lankan homes and have served the Sri Lankan consumer with high quality, affordable and innovative products. Both Atlas and Hemas have always felt that our most valuable asset is our team and we strive to empower the people in our organisation. I am deeply proud of the Atlas journey over the past 58 years and of the place that this brand holds in Sri Lankan consumers’ hearts. As we embark on the next phase of growth, we are delighted to have a high quality partner with similar values,” Madanayake added.

Hemas Holdings Group CEO Steven Enderby said: “Hemas Holdings PLC is expanding its presence in the Sri Lankan consumer market by acquiring one of the most respected local brands with market leading positions for its notebooks, pens, pencils and colour products. Today’s consumers seek out premium, innovative and design-oriented products and Atlas has demonstrated its ability to do this repeatedly, resulting in its unique position as the most loved school & office brand.

“Consumer stationery is a new and exciting category for Hemas with significant potential and we will bring the best of our consumer-focussed mindset to deliver superior value to Atlas’ many customers across the island. We look forward to working closely with the team at Atlas and building on their considerable success.”

Atlas will become the third largest business in the Hemas Group and will operate independently as a subsidiary of Hemas Holdings PLC. Hemas aims to continue to drive Atlas’ excellent track record of sales growth; and strengthen its market leading position, highly effective lean manufacturing and enviable dividend track record.

The Group will cross-fertilise brand and marketing insights between the business and its Home and Personal care portfolio as well as deliver route to market excellence through our two significant island wide sales and distribution networks. In addition, Hemas will look to reduce funding costs and enhance talent attraction and development at Atlas.

In April 2015 Hemas announced a Rights issue of Rs. 4.1 billion to be invested in FMCG and Healthcare businesses. During the first quarter of 2017, Hemas allocated Rs. 1.45 billion for the construction of the new Morison PLC pharmaceutical plant. The entire proceeds from the Rights issue have now been utilised with the acquisition of Atlas Axillia.

Atlas Axillia Co., formerly known as Ceylon Pencil Company (Pvt) Ltd. was founded in 1959 by the Madanayake Family. The brand “Atlas” has created a strong connection to the Sri Lankan consumer, fueled by a passion for providing school-children with the essential tools for success has been voted Sri Lanka’s most loved brand 2017 (No.1). The Company is the market leader in school stationery and notebooks, pens, pencils and colour products, with products retailed in over 70,000 outlets across Sri Lanka. Atlas Axillia brands include “Atlas”, “Zebra X”, “Homerun” and “Innov8”. The Company employs 1,300 people and operates two production facilities in Peliyagoda and Kerawalapitiya.

Hemas Holdings PLC, founded in 1948 is Sri Lanka’s leading Consumer and Healthcare business with further interests in Leisure and Mobility.

A-Sec Capital Ltd, the investment banking affiliate of Asia Securities Ltd, acted as arranger and sole advisor to the seller on this transaction.

Source : Daily FT

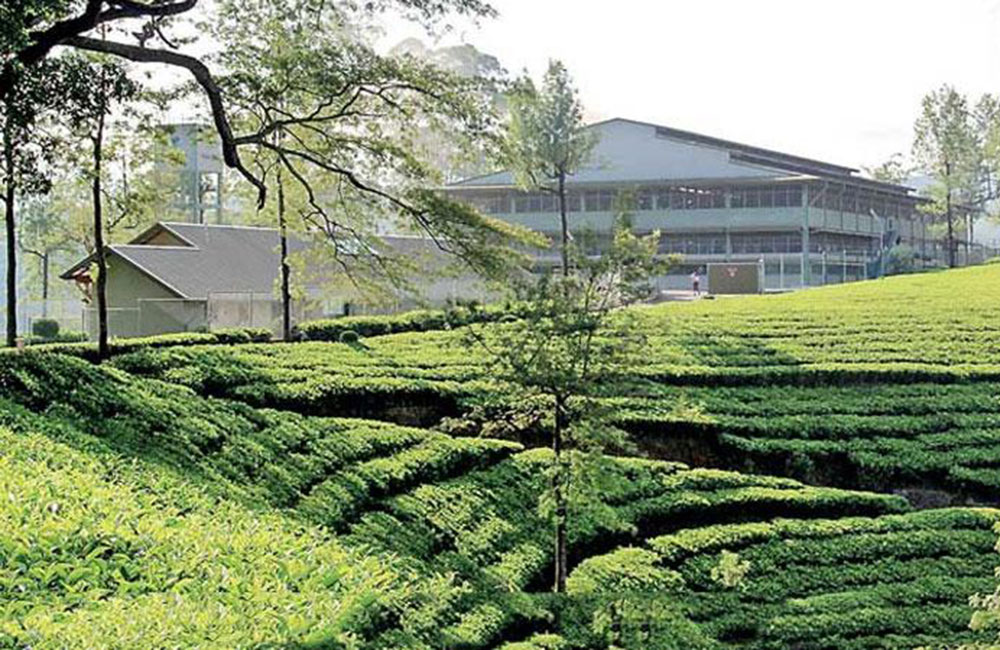

Tata Global Beverages plans to sell 31.85% stake in Sri Lankan plantation

Tata Global Beverages Ltd (TGBL) on Thursday said it had agreed to sell its 31.85% stake in Watawala plantations in Sri Lanka to Colombo-based Sunshine Holdings Plc.

In line with its strategy of focussing on packet tea businesses in key geographies, TGBL will sell its stake in joint venture Estate Management Services Pvt. Ltd, the managing agent for the Watawala plantations, for Rs120 crore, it said in a regulatory filing.

Caption: TGBL’s shares rose 0.5% at Rs306.6 on BSE, while the benchmark Sensex fell 0.19% to close at 33,848.03 points. Photo: India Post

Caption: TGBL’s shares rose 0.5% at Rs306.6 on BSE, while the benchmark Sensex fell 0.19% to close at 33,848.03 points. Photo: India Post

Following the exit of TGBL, Watawala plantations will become a joint venture between Sunshine Holdings, the dominant shareholder, and Singapore-based Pyramid Wilmar Plantations Pvt. Ltd.

TGBL, the erstwhile Tata Tea Ltd, had acquired a majority stake in Watawala plantations in 1996. In 2013, its stake in Estate Management fell from 49% to 31.85% when Pyramid Wilmar Plantations came in as a new partner. The book value of its investment, or the actual amount of money spent to acquire the interest, was Rs14.57 crore, according to TGBL’s latest annual report.

Apart from tea, Watawala plantations produce palm oil and dairy products.

Over the years, TGBL has been withdrawing from the plantations business. In 2005, it restructured its Indian plantations by creating two separate companies while divesting direct control among workers .

The company, however, continues to own 41% in Amalgamated Plantations Pvt. Ltd, which owns estates in West Bengal and Assam, and 28.5% in Kanan Devan Hills Plantations Ltd, which has gardens in Kerala. Both the companies have lately been running losses.

Tata group chairman N. Chandrasekaran had said at TGBL’s annual general meeting in August that the management was reviewing its investments in plantations, adding that a decision was soon to be taken about the two Indian plantations in which the company was still invested.

SONY's latest revolutionary mirror less camera now available in SL

The revolutionary mirror less camera, SONY Alpha - A7R III was officially launched in Sri Lanka on 16th of January 2018 at the Galle Face Hotel.

This camera has come to light with the ability to capture images at a rate of 10 per second at 42 Mega pixel resolution, while being able to focus even faster than its predecessors with improved 425 focus points. Moreover, with Pixel Shifting technology, the existing 42 Mega pixel sensor will be able to produce an image with almost 160 Mega pixel resolution.

The SONY A7RIII camera was introduced by the authorized dealer, CameraLK in collaboration with the product’s mother company; SONY.

https://casite-790485.cloudaccess.net/business?start=300#sigProId97ad71345b

China orders tech tycoon to return and face debts

The country's markets watchdog on Monday demanded LeEco founder Jia Yueting return to China before the end of the year to fix his business empire's financial woes.

The China Securities Regulatory Commission said that Jia, whose whereabouts are unknown, has not made good on earlier promises to provide interest-free loans to the embattled company.

LeEco did not respond to a request for comment following the unusual public statement from the regulator.

Once dubbed the Netflix (NFLX) of China, LeEco expanded from streaming into a wide array of industries such as movies, smartphones and transportation before it was compromised by heavy debts.

Jia made his ambitions known last year when LeEco invested in U.S.-based electric automaker Faraday Future, an apparent attempt to beat Tesla (TSLA) at its own game. At one point, the firm's shopping list also included U.S. electronics firm Vizio.

However, the company ran into trouble thanks to heavy borrowing.

Jia cut his own his own salary to just 1 yuan (about 15 cents) a year in late 2016. He admitted the company had been "burning money" and had "spent recklessly" on its expansion efforts.

LeEco later pulled the plug on a plan to buy Vizio for $2 billion.

Jia resigned as chairman and CEO amid moves by a Shanghai court to freeze personal assets of more than $180 million.

In October, rich-list compiler Hurun estimated that Jia's fortune had fallen by 95% to just 2 billion yuan ($306 million).

Source : CNN

‘Jan-Nov apparel exports surpasses entire 2016’

Sri Lanka is reporting a surge in latest apparel exports-and so upbeat on apparel performance for Y2017, it even forecasts the overall returns for the year.

“Our apparel revenues from January to November last year (2017) has exceeded Sri Lanka’s entire apparel exports for 2016 which was $ 4.3 billion” said the Minister of Industry and Commerce Rishad Bathiudeen on January 16 addressing the launch of ninth Apparel Industry Suppliers Exhibition (AISEX) 2018 by Lanka Exhibitions & Conference Services in Colombo. “The latest apparel export total from January to November last year (2017) is now reported by Sri Lanka Apparel Exporters Association at a strong $ 4.36 billion. In that our apparel revenues from January to November last year (2017) has exceeded Sri Lanka’s entire apparel exports for 2016 which was $ 4.3 billion. Therefore we now expect that the final total apparel exports for entire 2017 would clearly exceed the exports of 2016, and expect it to be in the range of $ 4.7 billion.”

“Even the November 2017 monthly apparel exports of $ 406 Million is an 11% increase in comparison to November 2016’s $ 364 Million” said Minister Bathiudeen.

“I praise Sri Lanka apparel industry and the exporters for this great performance. As you may already know Textile and Apparel are almost half of our total annual exports of all products. Our largest apparel export market is the US at around 42% followed by the EU at around 38%. What is more important is that two-thirds of the apparel workforces are women and therefore this sector is a major industry supporting the development of our female labour force. Therefore it is clear that events such as AISEX help strengthen our apparel sector in many ways.”

First held in 1998, today AISEX has become a major industry event in Colombo for apparel export manufacturers and industry suppliers of Sri Lanka and abroad.

The expo is scheduled to be held in Colombo in mid-May 2018.

The two major export destinations for Lankan apparel showed a positive trend In January-November 2017.

In this period, the total apparel exports to US was $ 1.959 Bn (slightly up from 2016 Jan-November’s $ 1.94 Bn), export to EU was at $ 1.84 Bn (up from 2016 Jan-November’s $ 1.80 Bn).

Source : Daily News

Bitcoin loses more than a third of value over a week

Bitcoin continues to give its investors a volatile ride. This week it has lost more than a third of its value from its record high of nearly $20,000.

On Friday, the cryptocurrency's price fell below $11,000, according to the Coindesk exchange website, before recovering to about $12,000.

This puts it on track for its worst week since 2013.

Bitcoin has had a blistering trip over the past 12 months. Its price at the start of the year was $1,000.

Charles Hayter, founder and chief executive of industry website Cryptocompare, said: "A manic upward swing led by the herd will be followed by a downturn as the emotional sentiment changes."

He said a lot of traders would have been cashing in on the spectacular gains made over the year.

The past few weeks have seen it gain some legitimacy after two major exchanges in the US started trading futures contracts underpinned by Bitcoin.

This allows investors to bet on where they expect the price of Bitcoin to be at certain points in the future.

Trading on Friday was so rocky both exchanges, the CME and the CBOE, stopped trading temporarily.

Many global exchanges have automatic brakes that apply once a commodity or asset has moved by a certain amount.

Regulators around the world have stepped up their warnings about its provenance as an investment.

Its origins are only barely understood, its volatility is extreme and its use as a currency is limited.

One of this week's most striking comments comes from Denmark's central bank governor, who called it a "deadly" gamble.

Earlier this month, the head of one of the UK's leading financial regulators warned people to be ready to "lose all their money" if they invested in Bitcoin.

Andrew Bailey, head of the Financial Conduct Authority, said that neither central banks nor the government stood behind the "currency" and therefore it was not a secure investment.

Source : BBC

Page 26 of 28