The ban on ethanol imports and the move of creating a state monopoly in local ethanol supply was aimed at flushing out existing liquor manufacturers from the arena and promoting new comers with the backing of ruling party bigwigs, industry sources claimed.

Further the delay in the clearance of ethanol tankers imported by local manufacturers placing orders and opening LC’s before the government’s ban on rectified spirit has crippled the local liquor manufactures.

While the Sri Lanka Customs claims the importation of ethanol has been temporarily banned, it has been revealed that a gazette notification in this regard has not been issued yet and the ban is being implemented on a letter sent by the Ministry of Finance on January 2 official documents revealed.

In a letter, Commissioner General of Excise A. Bodaragama has directed the manufacturers to purchase ethanol either from Pelwatte Sugar Distilleries (Pvt.) Ltd. or Lanka Sugar Company Ltd. – Sevanagala, two state-owned ethanol distilleries.

This move by the Department of Excise has bewildered the manufacturers as the restriction was neither officially announced nor pre-communicated, and is also being particularly targeted at them.

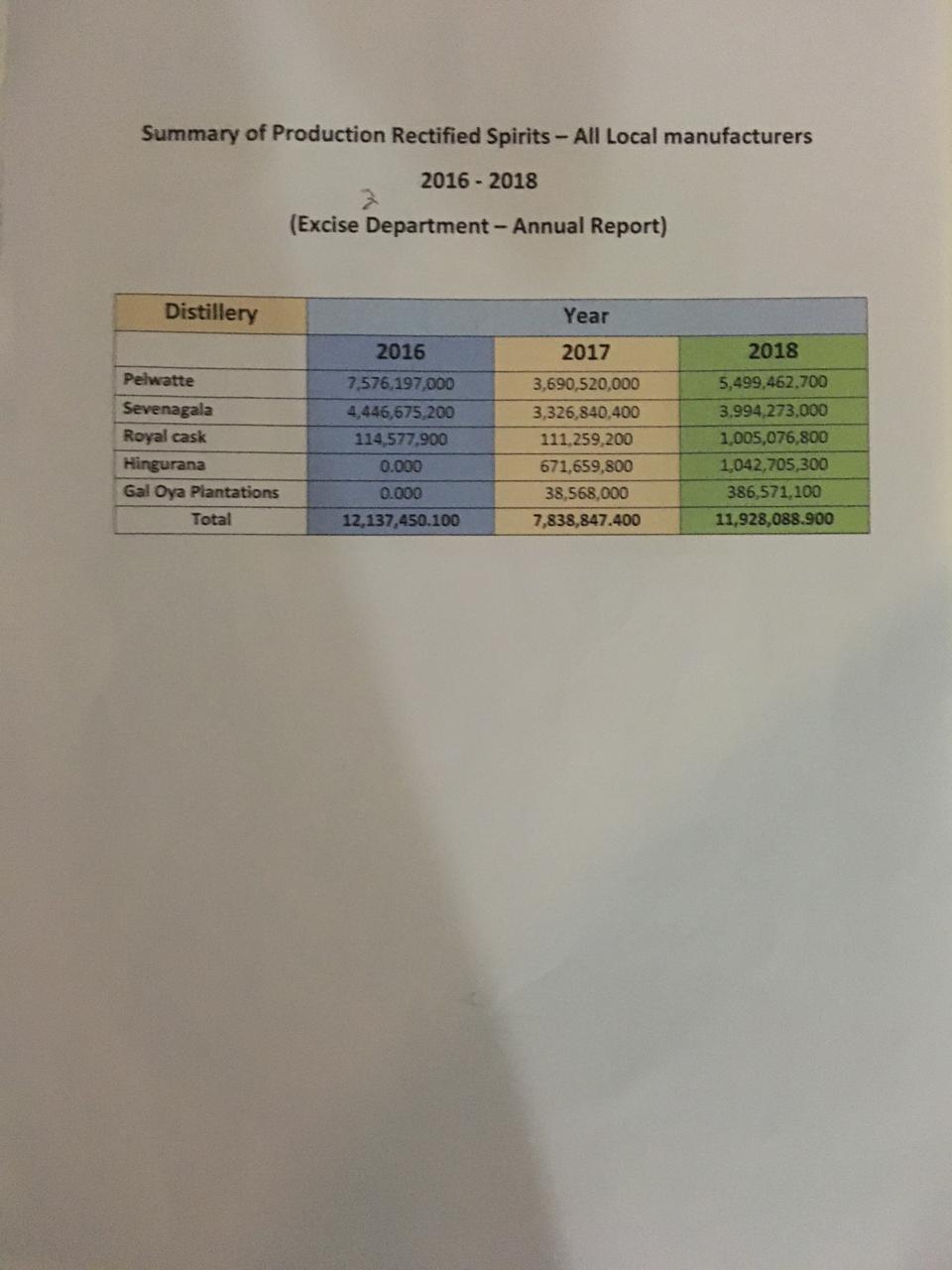

Earlier, alcohol manufacturers have been allowed to purchase from any local ethanol distillery, and If the Government sticks to the original ban, the liquor industry would cut their production, which would result in a significant loss of revenue to the Government, manufacturers added.

Manufacturers were purchasing ethanol from Royal Casks Distilleries (Pvt.) Ltd., the only distillery that produces ethanol using maize as raw material with international quality.

The Department of Excise has turned down a request from a leading manufacturer to purchase over 347,000 litres of ethanol from Royal Casks, they said.

Galoya Plantation (Pvt) Ltd. is reported to have been stock piling ethanol with a plan of opening a liquor bottling plant to enter into liquor production in a big way, informed sources said.

This company is managed as a Public-Private Partnership (PPP) between the Government and a consortium led by Brown & Company PLC and LOLC PLC.

According to the Ministry of Finance, the excise revenue target was Rs. 130 billion, out of which Rs. 68 billion was expected from the taxation of ethanol imports. During the financial year 2018/2019, Distilleries Company of Sri Lanka (DCSL) paid Rs. 58 billion in taxes, and Rs. 64 billion in taxes a year ago.

At least 22 licensed importers have been affected by the ban on ethanol imports and a very few of their containers (1 or 2) including 41 tankers imported by Distilleries Company of Sri Lanka (DCSL) are still to be cleared by Customs due to strict procedure of the department, several importers said.

They pointed out that the directive of the President to allow clearance of the quantity of ethanol shipments arranged before the ban will fulfill the local requirement temporarily but a shortage of ethanol based products and the loss of tax revenue will be resulted in the long run.

However, with the absence of competition due to ban on ethanol imports, the ethanol produced in Sri Lanka is alleged to be of lower quality, according to several alcohol manufacturers in the country.

They noted that using local ethanol in their production process could affect the taste and result in the increase of harmful chemicals in their end product.

“Therefore the restriction on the import of ethanol needs to be restored at an early date, as otherwise the production of illegal liquor in the illicit market would flourish, resulting in harmful health effects on consumers, ”they added.

Leave your comments

Login to post a comment

Post comment as a guest